Estimated learn time: 16 minutes, 54 seconds

It takes an unlimited period of time, cash, and headcount for SaaS corporations to deal with VAT, GST, and gross sales tax (and some other type of oblique tax) in-house. It’s a must to contemplate:

- Whether or not or not you’re required to gather and remit oblique tax (SaaS corporations didn’t all the time need to remit oblique taxes, nevertheless, many international locations now have new tax legal guidelines that focus on non-resident software program corporations).

- How a lot oblique tax you have to be amassing and remitting (figuring this out is never lower and dry — it sometimes needs to be completed by a tax specialist).

- How you’ll gather the correct quantity and kind of tax at checkout (there’s software program that can assist you gather gross sales tax (assuming you understand how to correctly configure to optimize and adjust to the greater than 10,000+ taxing authorities within the US), nevertheless, most software program is insufficient for amassing VAT, GST, and different types of consumption tax.

- Whether or not or not there are extra necessities for staying compliant (e.g., some international locations require you to file revenue tax along with oblique tax).

- How you’ll remit these taxes (that is not often so simple as filling out a type and chopping a examine; many international locations have extra necessities equivalent to having a consultant situated in that nation deal with your tax legal responsibility) …

… for each state, province, and nation you do enterprise in.

That’s why most companies flip to tax software program and/or tax consultants to assist them handle oblique tax.

On this information, we speak concerning the areas of amassing and remitting oblique tax that tax software program and tax consultants can and may’t assist you to with. Then, we’ll present how our answer, FastSpring, handles all points of amassing and remitting oblique tax for you.

Desk of Contents

FastSpring is greater than tax software program or a tax marketing consultant, we’re the Service provider of Document for corporations promoting digital items and software-as-a-service. Request a demo or join a free account to see how FastSpring may also help you increase globally virtually in a single day with out including headcount.

Be aware: The data contained on this article is to not be taken as tax recommendation.

What Tax Software program Can Assist You With

Most tax software program options present instruments for:

- Robotically calculating tax charges for every product at checkout.

- Filling out kinds to remit oblique tax.

- Registering your corporation in every tax jurisdiction.

- Figuring out once you’ve reached the legal responsibility threshold for particular places and due to this fact have to start out amassing and remitting taxes.

- And extra …

Disadvantages of Tax Software program

Drawback #1: You Must Manually Assign Tax Codes and Configure Your Checkout

To know the primary shortcoming of tax software program, we have to take a more in-depth have a look at the best way to use tax software program to calculate tax charges.

The quantity of tax that must be gathered at checkout is set by various elements:

- The kind of product you’re promoting

- The kind of buyer

- How a lot income you’ve earned from prospects in a given location

- If merchandise are bundled collectively

- The place your corporation has nexus

- And lots of extra

If even certainly one of these elements modifications, it could have an effect on how a lot tax it’s a must to gather and remit. For instance, software program bought as a subscription and hosted on a cloud-based server could also be taxed in another way than software program bought as a subscription however hosted on the vendor’s non-public, bodily servers.

Tax software program takes the most typical mixtures of those elements and labels them with a tax code (most tax software program will present a whole lot of various codes). To make use of the software program, you discover the matching tax code for every of your merchandise and configure your checkout to make use of the suitable tax code for every merchandise within the cart. Then, the tax software program mechanically calculates the suitable tax price (primarily based on the tax code you assigned and extra info gathered at checkout equivalent to the client’s location) and provides it to the customer-facing pricing.

It may be extraordinarily sophisticated to decide on the precise tax code.

For instance, let’s say your organization sells digital blueprints for constructing a DIY deck. With the blueprints, you additionally embrace a PDF with advisable designs for landscaping across the deck. Your tax software program provides you two completely different tax codes that appear to suit:

- A0002: For designs and plans despatched to the client through digital means solely.

- A3001: For blueprints despatched to the client through digital means solely.

Must you use tax code A0002 as a result of each the blueprints and the landscaping designs may fall beneath ‘designs and plans’? Or do you employ a mixture of each tax codes? Or do you employ the A3001 code for the blueprints and provide the landscaping design plans as a free bonus? Or one thing else altogether?

Most corporations discover they want a tax specialist to deal with assigning the precise tax code to every product.

Then, you continue to need to do the guide work of establishing your checkout to make use of the suitable tax code for every merchandise within the cart (which usually takes hours of setup and ongoing upkeep).

Drawback #2: You’re Held Liable

A typical misunderstanding is that tax software program suppliers are chargeable for making certain the right amount of oblique tax is collected at checkout. Nonetheless, that’s not the case. Most tax software program features a line much like the next:

“Whereas we attempt to make these instruments as correct as potential, please bear in mind that you’re chargeable for figuring out the suitable tax codes.” – Avalara

Which basically implies that if the unsuitable quantity of tax is collected for any cause, you’re held accountable.

Even when the tax software program fails to calculate the correct quantity of tax or they expertise a glitch of their system and cease amassing tax altogether in a selected area, the tax software program doesn’t need to cowl the funds for these taxes — as a substitute, it should seemingly come out of your pocket.

(The identical is true if you happen to by accident assign the unsuitable tax code or your checkout is configured incorrectly and never amassing the correct quantity of tax.)

Moreover, if you happen to get audited, you’ll be by yourself. Some tax software program corporations will present on-demand reviews and assist docs that can assist you get via audits, but it surely’s finally as much as you to give you a response.

Lastly, when you’ve got questions on the best way to optimize tax charges, qualify for lowered tax charges, or some other tax-related query, you’ll seemingly be advised to seek the advice of your tax advisor or learn via the assistance articles.

Drawback #3: Most Tax Software program Is Insufficient for Accumulating VAT, GST, and Different International Consumption Tax

Whereas there are good options for calculating gross sales tax charges in the USA, most are inadequate for amassing oblique tax for transactions exterior of the U.S. Many SaaS corporations run into conditions the place their tax software program is calculating the unsuitable quantity of VAT or GST, can’t calculate tax charges for international locations they need to do enterprise in, or doesn’t present the required tax code for his or her product in all international locations. Due to this, most SaaS corporations find yourself calculating oblique tax exterior of the U.S. on their very own.

Drawback #4: You’re Restricted to the Tax Codes They Present

Tax software program sometimes supplies a whole lot of tax codes that cowl completely different variations of services, so most corporations can discover a tax code that matches their product. Nonetheless, when you’ve got a services or products that isn’t coated by a tax code, you’ll be by yourself to gather the relevant tax.

What Tax Consultants Can Assist You With

Tax consultants may also help you:

- Keep up-to-date on the tax legal guidelines of every jurisdiction you do enterprise in.

- Present suggestions about when it’s time to start out remitting tax in a selected jurisdiction and the best way to implement measures for compliance.

- Remit oblique tax on the applicable time. (Remember: Not all tax consultants will provide this service, so you might also want to rent an accountant.)

Be aware: Some tax consultants focus on gross sales tax compliance within the U.S. or tax on tangible private property and don’t essentially focus on tax legal guidelines for digital merchandise or worldwide transactions. So, you’ll need to select your tax marketing consultant fastidiously — many SaaS corporations want a number of tax consultants to cowl all their bases.

Disadvantages of Tax Consultants

Tax consultants may also help you keep up-to-date on legal guidelines and rules, however it’s a must to resolve what to do with that info. Only a few tax consultants offers you easy recommendation on the best way to deal with particular conditions. As an alternative, they’ll most definitely inform you of the legal guidelines and the way different corporations have dealt with varied conditions previously. In the event that they do provide recommendation, it’s typically very conservative.

For instance, let’s say a rustic you’re transacting in handed a brand new legislation requiring consumption tax on some digital items gross sales. Their pointers aren’t very clear so that you don’t know in case your product qualifies or not. A tax marketing consultant will seemingly advise you to go forward and file taxes even when there’s a great probability that your product gained’t qualify as soon as the rules are clarified. In the event you do resolve to file and later discover out that you just didn’t must, the tax you already paid is gone and gained’t be refunded.

Some corporations would somewhat take the danger and never file on this scenario, nevertheless, only a few tax consultants will suggest that plan of action. Both means, it’s totally as much as you to resolve what to do with the knowledge your tax marketing consultant supplies, and also you’ll be the one held liable.

FastSpring: Let Us Deal with Gross sales Tax, VAT, and GST Legal responsibility for You

The challenges talked about above with tax software program and consultants are one of many causes we created our answer, FastSpring.

FastSpring combines the advantages of tax software program and tax consultants and overcomes the disadvantages of each by appearing as your Service provider of Document (MoR), which implies we totally care for gross sales, VAT, and GST taxes for you.

Particularly, as MoR we:

- Tackle tax legal responsibility

- Assist you assign tax codes

- Calculate tax charges

- Gather and remit gross sales tax, VAT, and GST

- Take the lead on audits

- And far more …

You management your product, the checkout expertise, and branding. We merely offer you an entire fee answer and care for gross sales tax, VAT, and GST for you.

“The choice to maneuver to FastSpring was a fancy one, however one of many key elements was the truth that FastSpring was easing our administrative burden relating to international tax and VAT administration, and the variety of invoices that we would have liked to register.”

— Ovi Negrean, Co-Founder and CEO at SocialBee

Click on right here to learn the SocialBee case research.

Within the following sections, we dig into what it seems to be wish to have FastSpring as your MoR.

Get the Proper Tax Codes for Each Product

Our workforce of tax professionals assigns tax codes to all of your merchandise so your workforce doesn’t need to. Simply inform us about your product and we care for the remainder.

As we talked about earlier, most tax software program has a restricted variety of tax codes. If certainly one of your services or products doesn’t match into a kind of tax code descriptions, you’ll be by yourself to calculate the suitable tax price.

FastSpring solves this drawback by providing customized tax codes. We are able to create a singular tax code for any services or products in only a few minutes.

Calculate and Gather Tax at Checkout With Minimal Setup

Our workforce ensures the right amount (and kind) of oblique tax is being collected at checkout — we even deal with tax-exempt transactions within the U.S. and 0% reverse costs when allowed internationally.

Though we calculate and gather oblique taxes for you, you’ll have full management over the appear and feel of your checkout. Right here’s a short overview of the choices you’ll have on your checkout:

- Three choices for setup: You possibly can have your checkout popup over your web site or embedded into your web site. You may also redirect prospects to an online storefront hosted by FastSpring.

- Visible customization choices: You possibly can change the appear and feel of your checkout with CSS overrides and customized model instruments.

- Customise the client’s journey. FastSpring’s JavaScript Retailer Builder Library enables you to add FastSpring parts (e.g., buttons) to steps main as much as checkout. This allows you to handle upsells, cross-sells, and extra.

- Localization: FastSpring mechanically converts costs to the native foreign money and interprets textual content to the native language primarily based on the client’s location (you may as well let the client select their most popular language/foreign money).

- Dozens of most popular fee strategies around the globe. FastSpring companions with fee gateways focusing on international transactions so you may provide dozens of fee strategies (and guarantee excessive authorization charges).

“At DaisyDisk, we’re obsessive about the consumer expertise. We selected FastSpring as a result of it supplies a straightforward, localized buying expertise for each buyer, in all places. FastSpring handles all the small print — we don’t even have to consider it.”

— Oleg Krupnov, Founder and CEO at DaisyDisk

Click on right here to learn the DaisyDisk case research.

Guarantee Full Tax Compliance in Each Jurisdiction You Do Enterprise In

Our workforce remits oblique taxes for you and ensures all the required procedures are in place for full compliance.

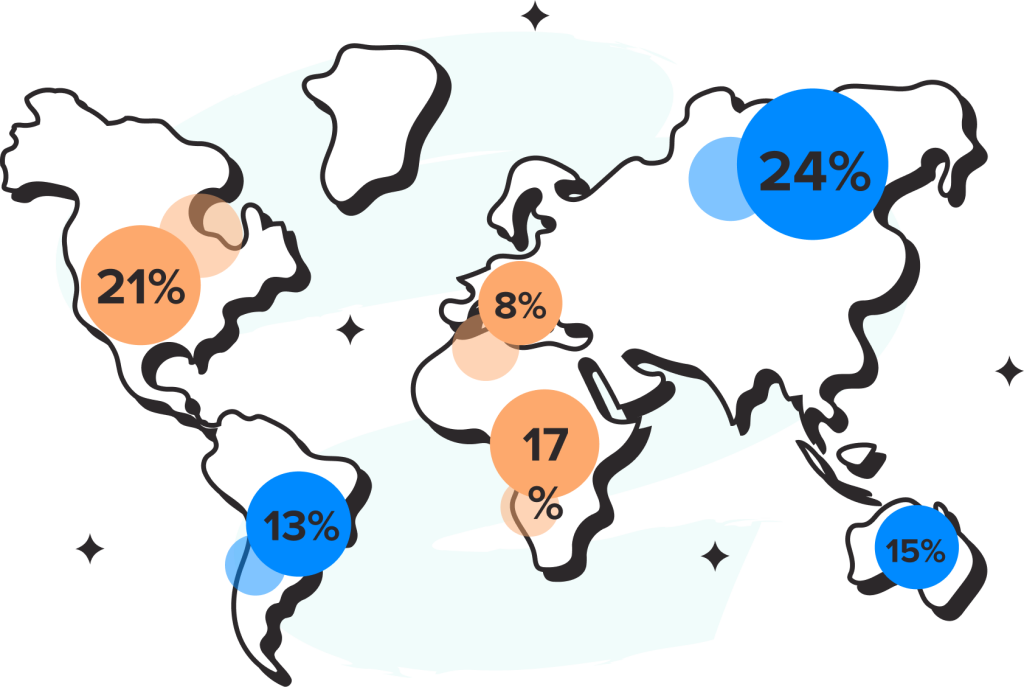

With over 20 years of expertise submitting 1,200+ tax returns every year, we all know what it takes to remain compliant throughout the globe. FastSpring is compliant in 52 international locations, 13 provinces, and all 45 U.S. states that gather gross sales tax (5 states don’t gather gross sales tax).

If you wish to increase into a brand new territory, simply attain out to us and we’ll begin the method for sustaining compliance in that area.

“Because of FastSpring, we entered the worldwide market and are efficiently receiving funds from prospects from all around the world.”

— Paul Mit, Co-Founder and Chief Development Officer, FlowMapp

Click on right here to learn the FlowMapp case research.

Be aware: Some international locations have been sanctioned by the USA Authorities, which means all transactions inside that nation are prohibited. FastSpring adheres to those legal guidelines.

Backed by Tax Specialists Across the World

Not solely do now we have a devoted in-house workforce with over ten years of expertise, however we additionally construct and preserve relationships with tax specialists the world over. This ensures we’re conscious of legal guidelines and rules as they modify.

Within the case of audits, our workforce takes the lead. If a rustic or state approaches you about tax compliance, our workforce will typically present copy-and-paste responses.

Deal with Oblique Tax and Your Total Fee Platform for One Flat-Price Charge

FastSpring supplies options for the complete fee lifecycle, together with:

- International fee processing

- Subscription administration

- Checkout

- Digital invoicing (for B2B transactions)

- Reporting and analytics

- And far more …

All FastSpring options are provided for one flat-rate price primarily based on the amount of transactions you progress via our platform. There aren’t any hidden charges and also you gained’t be charged till a transaction takes place.

Request a demo or join a free account to be taught extra.

“We have been targeted on not solely discovering an ecommerce platform that labored but additionally on constructing a relationship and partnership, which I imagine is essential. You don’t need to purchase one thing after which be alone. You want a great partnership. Ultimately, we picked FastSpring as a result of they confirmed us they wished to be a real companion.”

— Frederic Linfjärd, Digital Business Supervisor at Seize One

Click on right here to learn the Seize One case research.

Conclusion: Tax Software program vs. Tax Consultants vs. FastSpring

FastSpring is the one answer on this information that takes on oblique tax legal responsibility for you. Plus, we automate the complete technique of calculating, amassing, and remitting oblique tax.

Tax software program and tax consultants may be helpful if you happen to’re set on dealing with oblique taxes your self, however be ready to dedicate an unlimited period of time and sources to the duty.

In the event you suppose FastSpring is the precise tax answer on your SaaS enterprise, request a demo or join a free account.

Continuously Requested Questions

What Are SaaS Tax Necessities by State?

Whereas there are some generalizations that may be made, every state can have its personal tax guidelines for a way they tax SaaS merchandise — and people gross sales tax legal guidelines are continuously altering. Moreover, every zip code inside every state could also be taxed in another way (leading to 12,000+ taxing jurisdictions all through the U.S.).

Right here’s a short overview of gross sales tax obligations by state (on the time of writing).

SaaS is taxable in Alaska, Arizona, Hawaii, Kentucky, Louisiana, Massachusetts, New Mexico, New York, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Washington, and West Virginia.

SaaS is non-taxable in Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New Hampshire, North Carolina, North Dakota, Oklahoma, Oregon, Vermont, Virginia, Wisconsin, and Wyoming.

Some SaaS could also be taxable (relying on if it’s for enterprise use or private use) in Connecticut, Iowa, Maryland, and Ohio.

SaaS is partially taxable in Texas.

Is SaaS Taxable Internationally?

Sure. Though not each nation taxes gross sales of digital items, an increasing number of international locations are passing legal guidelines focusing on nonresident software program corporations to be able to stage the taking part in subject for native corporations (who’re at an obstacle if their abroad rivals will not be required to gather tax).

What’s the Danger of Ignoring Gross sales Tax, VAT, and GST?

The danger of ignoring gross sales tax, VAT, and GST shall be completely different for firm and jurisdiction. Nonetheless, right here are some things to think about:

- You possibly can find yourself owing enormous fines and penalties.

- You possibly can be banned from transacting in that state, nation, or province.

- You possibly can find yourself paying years value of oblique taxes. (In the event you gather oblique taxes in the correct quantity, you gained’t need to pay something. However, if you happen to aren’t amassing oblique taxes, these taxes will come out of your pocket.)

- It may have an effect on the valuation of your organization. (We’ve seen million greenback value changes as a result of a small software program firm was noncompliant with oblique tax legal guidelines.)

- Your organization may very well be added to a public blacklist to encourage folks to not do enterprise with you.

Study extra: Can SaaS Firms Afford to Ignore Gross sales Taxes and VAT? – FastSpring

What Is “Nexus”?

Nexus thresholds are what decide whether or not or not it’s a must to cost gross sales tax in a given state. Traditionally, an organization needed to have a bodily presence in a state (i.e., an workplace constructing or distant workers) to be able to fall beneath that state’s gross sales tax jurisdiction.

Nonetheless, the USA Supreme Courtroom’s ruling on South Dakota vs. Wayfair in 2018 modified that. Now, every state can contemplate income earned when figuring out nexus. For a lot of states, the financial nexus threshold is $100,000. In the event you earn over $100,000 in income from transactions in that state, you’ll be required to gather and remit gross sales tax — even if you happen to don’t have a bodily presence in that state.

What’s within the Future for Oblique Tax Necessities for SaaS?

An increasing number of international locations that didn’t tax gross sales of digital items are passing new legal guidelines that focus on nonresident SaaS corporations. And, many international locations are discovering methods to implement their tax legal guidelines extra strictly.

Moreover, the EU is rolling out digital invoicing necessities in 2028 (many international locations have already got this requirement in place for enterprise with authorized entities in that nation). It will require all companies — resident and non-resident — to submit digital invoices in real-time for each transaction. Not solely will this assist them implement compliance with VAT legal guidelines, however many international locations will seemingly comply with go well with.