Gross sales is never directionless. Each facet of the observe requires established expectations and a point of steering — and in lots of circumstances, “expectations and steering” quantity to agency predictions of a gross sales org’s efficiency.

These predictions usually come within the type of one thing often called a gross sales funds — a doc that units lifelike requirements for the way a lot a gross sales org is predicted to promote inside a given time-frame.

These plans are central to processes like objective setting and forecasting. To assist in giving you a greater grasp on gross sales budgets as an idea, we’ve gathered some key data that may allow you to higher perceive the what, why, and how behind these paperwork.

What’s a gross sales funds?

A gross sales funds is an itemized plan that predicts your complete anticipated gross sales income by contemplating the variety of items you anticipate promoting and the value you plan to promote them at. It units a reference level for the way a lot cash you count on to herald throughout a given interval to information objective setting and monetary forecasting.

Gross sales budgets are sometimes conflated with gross sales forecasts. That form of mix-up is smart. The 2 are basically related in that they each supply some form of prediction of gross sales figures over a given interval, however they differ by way of intent and time-frame.

A gross sales funds offers a sensible however ultimate course in your firm to pursue. It offers a baseline understanding of what it’s best to count on out of your gross sales org, and a gross sales forecast is commonly a pure extension of that.

Gross sales forecasts take the data from the funds and set predictions for the way probably you’re to dwell as much as these expectations. Forecasts additionally are likely to cowl smaller intervals of time. They often set predictions on a weekly, month-to-month, or quarterly foundation.

Gross sales budgets, then again, sometimes account for a whole 12 months.

Why are gross sales budgets necessary?

Setting a sensible gross sales funds is necessary for measuring the success of your gross sales crew. By projecting how a lot it’s essential spend on gross sales all year long, you may meet firm expectations and keep away from pointless bills.

One other method to consider your gross sales funds is to consider it along with your gross sales objectives. To satisfy your objectives this upcoming 12 months, what bills may you incur? By answering and evaluating this query, you can also make certain your gross sales funds maximizes revenue whereas encouraging firm progress.

The Function of a Gross sales Finances

Gross sales budgets and the perception they provide have a wide range of functions. Listed below are a few of the most prevalent ones.

Dictate Bills

A gross sales funds guides a corporation’s monetary planning and aims. It offers managers a reference level for the expectations and requirements they’re working with. With that image in thoughts, leaders can set better-informed, simpler overhead and administrative budgets.

Assist Set Goals

A gross sales funds units agency expectations for profitability — giving your gross sales org a kind of North Star for its anticipated efficiency and the objectives it must set to appreciate it. This plan can even assist with setting quotas and retaining extra correct tabs on crew efficiency.

Measure Final Efficiency

At its core, a gross sales funds is a benchmark in opposition to which a gross sales division’s success may be measured. It units definitive expectations for what your organization expects your org to ship and, in flip, a approach to see how efficient its course of and efforts are.

With out one, you’ll have a more durable time figuring out whether or not your gross sales methods helped or harm your final efficiency.

What parts ought to a gross sales funds embrace?

When diving into gross sales forecasting or funds preparation, it’s necessary to make sure your parts are ready and correct earlier than beginning your plan.

Relying on the dimensions of your corporation, you will have a bigger or smaller gross sales funds spreadsheet than others, however irrespective of your organizational dimension, contemplate figuring out these three key parts.

Money Circulation Assertion

A money move assertion (CFS) summarizes how money and money equivalents transfer out and in of your gross sales crew. A CFS measures how your crew manages its debt whereas funding working bills.

Your CFS may embrace:

- Curiosity funds.

- Hire/mortgage funds (if relevant).

- Revenue tax funds.

- Receipts from gross sales.

- Wage and worker wages.

- All different working bills.

Steadiness Sheet

A steadiness sheet is a monetary doc that particulars how a lot your group is price by itemizing out all belongings, liabilities, and fairness your organization has by a particular reporting date.

A steadiness sheet could be ready and distributed on a quarterly or month-to-month foundation, relying on native legal guidelines or firm coverage.

A gross sales crew steadiness sheet is necessary as a result of it provides perception into the well being of your crew. Your steadiness sheet can be utilized by potential traders to resolve whether or not or to not put money into your organization.

Revenue Assertion

An earnings assertion is the web earnings of your division, which supplies a basic overview of your monetary state. Your earnings assertion will checklist bills, good points, income, and any losses your corporation skilled throughout a particular time interval.

An earnings assertion offers perception into the effectivity of an organization, which sections are underperforming, and your efficiency relative to different departments.

By figuring out your money move assertion, steadiness sheet, and earnings assertion, it’s best to have a greater concept of the general monetary well being of your gross sales crew and which areas want enchancment.

Easy methods to Put together a Gross sales Finances

1. Set a time-frame.

Gross sales budgets cowl fastened intervals of time — sometimes one 12 months at a time. That stated, gross sales budgets can be set to cowl weeks, months, or quarters. Regardless of the time-frame you go together with, if you wish to put together a gross sales funds, you need to begin with the when.

2. Discover your costs.

The subsequent key element of a gross sales funds is pricing.

You may’t predict income when you don’t understand how a lot every unit you promote goes to price, so you need to pin that aspect of your plan down proper off the bat. And if there’s any probability these costs are going to fluctuate at any level in your chosen time-frame, it’s essential account for that as properly.

3. Have a look at earlier knowledge from an identical interval.

Right here’s the place you begin attempting to know what to anticipate out of your gross sales efforts. A technique to try this is to tug historic knowledge that gives some perspective on how your gross sales org sometimes performs across the time of 12 months you’re budgeting for.

4. Evaluate your knowledge to your trade and competitors.

One other angle you may take when getting ready a gross sales funds is to take a look at your aggressive panorama. How are your trade friends performing?

Should you and one other firm share an identical market place, attempt to look into its gross sales figures to higher perceive what you may count on out of your prospects and clients.

5. Discuss to clients.

Generally it helps to listen to instantly out of your patrons to get a pulse in your providing’s attraction, longevity, and potential profitability. Are folks nonetheless smitten by your services or products? Is there a competitor which may siphon shoppers’ curiosity in your corporation?

Taking motion like sending surveys or instantly speaking together with your base can supply some invaluable data to form your gross sales funds.

6. Determine market developments.

How has the product in your market been trending not too long ago? You may solely perceive your future efficiency so properly from wanting into the previous.

If the marketplace for your product service has been constantly trending downwards in recent times, your historic knowledge won’t do all that a lot for you. Bear in mind, you’re predicting gross sales figures — not copying them.

7. Create your funds.

With the listed components — amongst others — behind you, you may get a strong really feel for what number of items you may count on to promote and, in flip, put collectively an correct gross sales funds.

Gross sales Finances Templates

The construction of your gross sales funds will fluctuate primarily based on the variety of services or products you promote and whether or not you supply any kind of reductions. Listed below are a number of templates that cowl these bases.

One Product or Service With No Reductions

|

Q1 |

Q2 |

Q3 |

This fall |

Annual |

|

|

Anticipated Unit Gross sales |

|||||

|

x Worth per Unit |

|||||

|

= Whole General Income |

A number of Merchandise or Companies

|

Q1 |

Q2 |

Q3 |

This fall |

Annual |

|

|

Anticipated Unit Gross sales #1 |

|||||

|

x Worth per Unit |

|||||

|

= Whole Income #1 |

|||||

|

Anticipated Unit Gross sales #2 |

|||||

|

x Worth per Unit #2 |

|||||

|

= Whole Income #2 |

|||||

|

= Whole General Income |

One Product or Service With Reductions

|

Q1 |

Q2 |

Q3 |

This fall |

Annual |

|

|

Anticipated Unit Gross sales |

|||||

|

x Worth per Unit |

|||||

|

= Gross Gross sales Income |

|||||

|

– Gross sales Reductions |

|||||

|

= Whole Internet Gross sales |

Examples of Gross sales Budgets

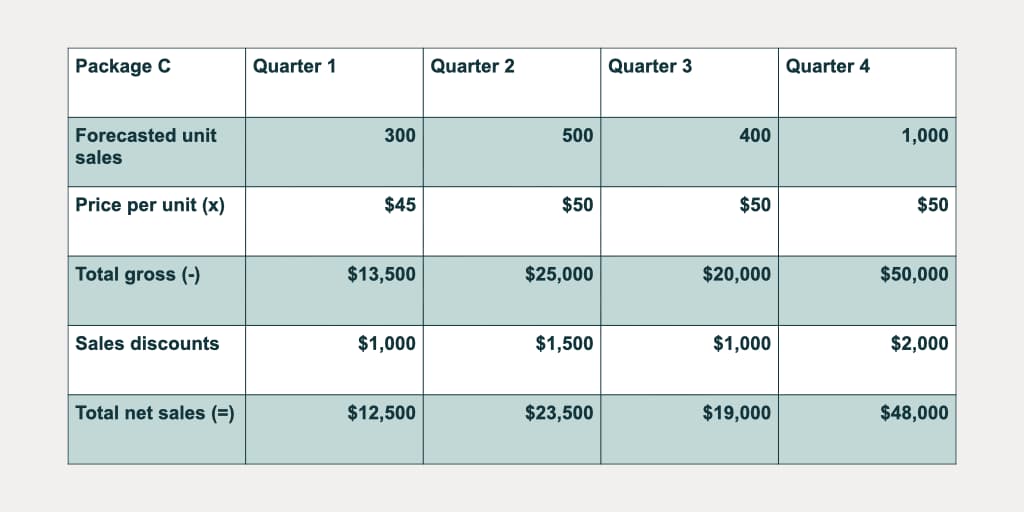

Right here’s an instance of a gross sales funds from a agency that expects to see various gross sales at completely different worth factors all year long.

|

Q1 |

Q2 |

Q3 |

This fall |

Annual |

|

|

Anticipated Unit Gross sales |

11,000 |

11,500 |

12,000 |

11,500 |

46,000 |

|

x Worth per Unit |

$45 |

$45 |

$47.50 |

$47.50 |

|

|

= Whole General Income |

$495,000 |

$517,500 |

$570,000 |

$546,250 |

$2,128,750 |

Right here’s an instance of a gross sales funds from the identical agency, however together with a projected 5% gross sales low cost and allowances to find out their complete internet gross sales.

|

Q1 |

Q2 |

Q3 |

This fall |

Annual |

|

|

Anticipated Unit Gross sales |

11,000 |

11,500 |

12,000 |

11,500 |

46,000 |

|

x Worth per Unit |

$45 |

$45 |

$47.50 |

$47.50 |

|

|

= Gross Gross sales Income |

$495,000 |

$517,500 |

$570,000 |

$546,250 |

$2,128,750 |

|

– Gross sales Reductions (5%) |

-$24,750 |

-$25,875 |

-$28,500 |

-$27,312.50 |

-$106,437.50 |

|

= Whole Internet Gross sales |

$470,250 |

$491,625 |

$541,500 |

$518,937.50 |

$2,022,312.50 |

Gross sales Finances Finest Practices

Understanding the way to craft an correct gross sales funds may help maintain your gross sales org on monitor and working as effectively as doable. Listed below are finest practices that can assist you get began.

Put together for surprising bills.

Even the perfect funds wants slightly wiggle room for surprising expenditures. With inflation and potential financial uncertainty, costs of airfare, motels, and dinners can unexpectedly improve in worth. In case your gross sales crew attends exhibits, these turbulent costs will affect your funds.

Even when you don’t journey, delivery prices have elevated and can probably proceed to take action. Be sure to’re conscious of bills associated to gross sales offers and product launches within the coming 12 months.

Plan your aims.

What objectives does your gross sales crew need to accomplish this 12 months? Do you’ve got a income objective or maybe a brand new buyer objective? By figuring out these objectives, it is possible for you to to anticipate a few of your upcoming bills.

You’ll want to checklist out how you’ll obtain your upcoming objectives, with benchmarks you’ll meet alongside the best way.

Anticipate your upcoming gross sales 12 months.

With a possible recession on the horizon, how may your clients’ spending change? Should you promote nonessential merchandise, you’ll need to anticipate any dips in gross sales or income and plan accordingly.

You need your gross sales funds to replicate the market. If the market is tight and unpredictable, you need your funds to be each complete and adopted strictly.

Constructing Your Gross sales Finances

An in depth gross sales funds may help your crew have a productive 12 months by assembly objectives and ensuring you’re fiscally conservative. You’ll want to current your funds to executives and crew members quickly after it’s drafted. Verify again usually to make sure you’re on the right track to be below funds every quarter.

.jpg#keepProtocol)