Estimated learn time: 7 minutes, 56 seconds

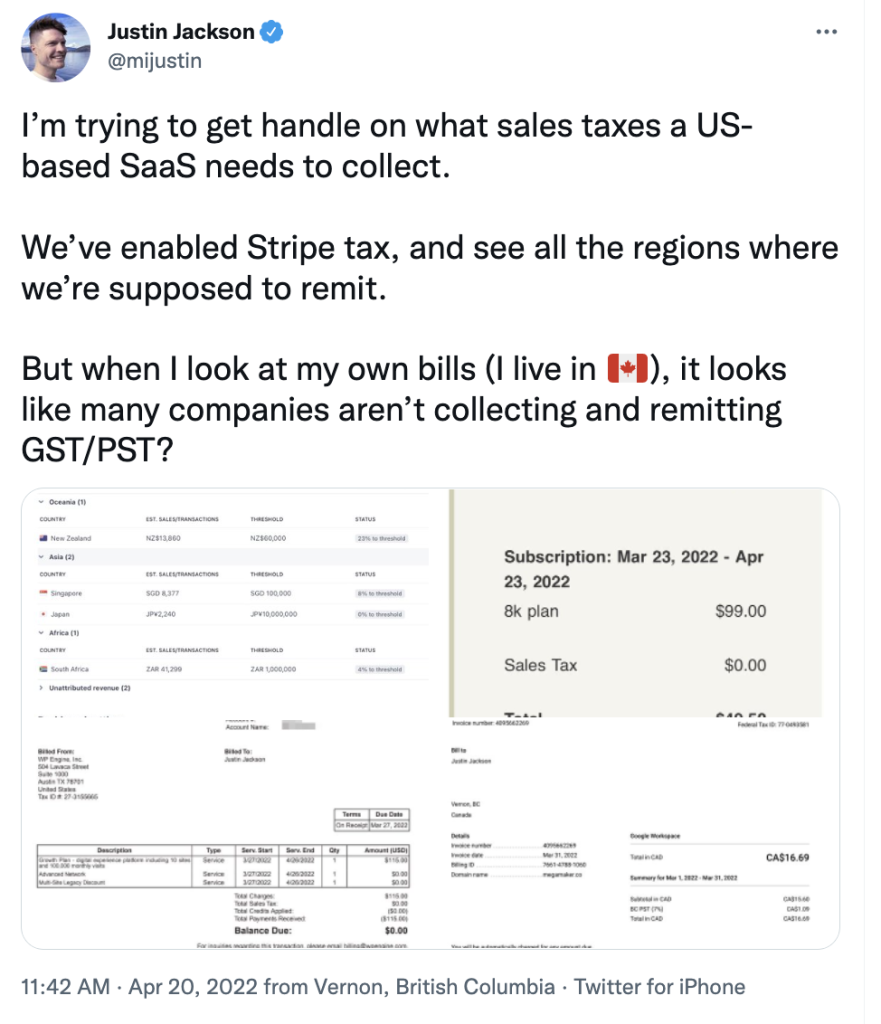

One of many issues I’ve discovered whereas working at FastSpring is how widespread it’s for SaaS and software program corporations to disregard transaction-related taxes (gross sales taxes, VAT, GST, and many others.).

And I get it.

Gross sales taxes, VAT, and GST are difficult, complicated, and never what software program leaders wish to spend their time on.

But in addition, you must know that ignoring transaction-related taxes has dangers nicely past paying some again taxes at a while sooner or later.

Throughout certainly one of my conversations with FastSpring’s International Tax Director Rachel Harding, essentially the most educated particular person I learn about this subject, she instructed me about:

- 40% curiosity and penalties she’s seen software program corporations accrue once they’ve ignored state gross sales tax necessities.

- Multi-million greenback valuation changes from historic gross sales tax noncompliance throughout acquisition due diligence.

And rather more.

So to reply our personal query: No, you shouldn’t ignore taxes in 2022.

On this piece, we cowl 5 issues SaaS corporations want to grasp about taxes. A lot of it’s taken from my conversations with Rachel. Under, you can even stream two of our conversations to listen to extra.

5 Issues SaaS Corporations Have to Perceive About Gross sales Taxes

1. Gross sales, VAT, and GST Taxes Can Have an effect on SaaS Valuations

When Rachel was engaged on a mergers and acquisitions tax staff for small software program corporations, she noticed million-dollar buy worth changes on account of tax noncompliance.

“In case you’re seeking to have any form of possession change, majority or minority funding, individuals wish to look into your organization,” Rachel defined. “They’ll take a look at all of your processes, like do you might have a deal with on the place your merchandise are taxable? Are you watching these guidelines, accumulating and remitting? Are you compliant? As a result of if not, you’ll need you to repair it earlier than they purchase it, or they’ll simply dock the acquisition worth.”

“In case you do it proper, technically, it’s net-zero to you,” Rachel defined.

Gross sales tax is a consumption tax — a tax on the buyer, not on your corporation. It shouldn’t be one thing you’re paying out of pocket. However it’s as much as you to acquire gross sales tax on the client’s behalf — and remit it to the suitable authorities company. It’s a purchaser’s legal responsibility, however a vendor’s obligation.

“It’s while you’re doing it unsuitable that it turns into an expense and legal responsibility in your stability sheet. Feasibly, you’re not going to evaluate a buyer gross sales tax two years after it was due. So then it’s all out of pocket.”

3. Consumption Taxes Are Calculated Primarily based on the Location of the Purchaser, Not the Vendor

Gross sales taxes are difficult (particularly in locations just like the U.S.), however basically, the factor to know is that gross sales tax is collected the place the good thing about the merchandise is consumed (aka the place your buyer is positioned). It’s not calculated primarily based in your location, or the situation of your organization’s headquarters.

In apply, essentially the most significant knowledge for sourcing gross sales is the billing and laptop IP handle. Because the title implies, SaaS is taxed equally to companies and never items, that means solely 20 of 45 U.S. states with gross sales tax regimes really tax SaaS. And since 2018, in case you have sufficient taxable gross sales in a area that exceeds the desired threshold, then you might be deemed to have financial nexus (an enormous shoutout to South Dakota v. Wayfair for this idea!).

A gross sales threshold is the quantity of gross sales you might have in a selected jurisdiction earlier than you need to file taxes. Every tax area (whether or not it’s on a state, territory, or nation degree) has distinctive methods of defining a threshold.

4. Tax Legal guidelines and Laws Have Modified Dramatically within the Final 10 Years

Gross sales taxes, VAT, and different transaction-related taxes have modified rather a lot previously ten years. Some modifications are extra necessary than others and have modified the panorama completely.

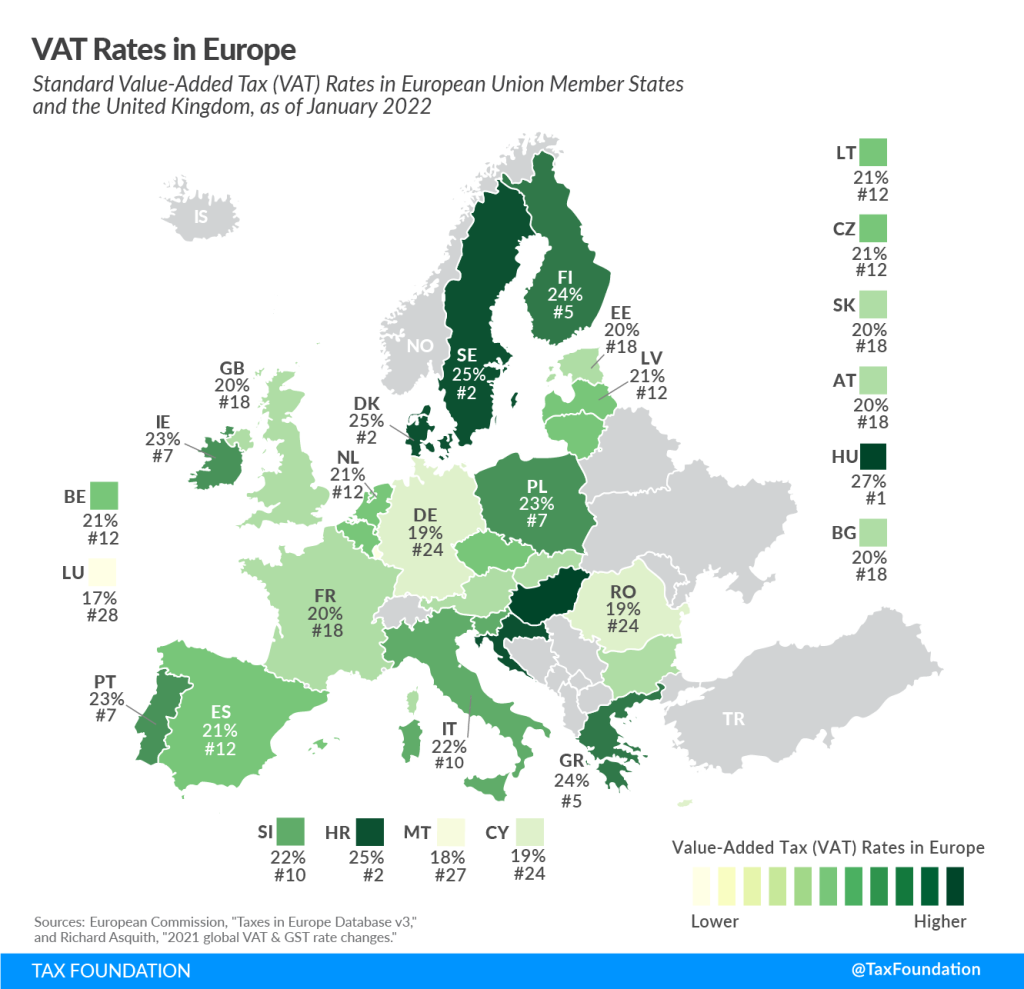

2015: EU Requires VAT Assortment From Non-EU Software program Corporations

On January 1, 2015, the EU started requiring software program sellers to gather and remit VAT primarily based on the situation of the customer — not the situation of the vendor’s firm or staff.

VAT charges are set by the nation, that means nations are accountable for maintaining with modifications to those charges on a rustic degree.

2018: U.S. Votes That States Can Gather Gross sales Taxes From Non-Resident Companies

In 2018, the U.S. Supreme Courtroom dominated that states could cost gross sales tax on purchases created from out-of-state sellers (together with on-line sellers), even when the vendor doesn’t have a bodily presence within the taxing state (South Dakota v. Wayfair, Inc.). (A.okay.a. the explanation we’re writing this text since now nonresidents and small companies want to grasp gross sales tax and its software.)

Within the U.S., gross sales tax rules differ from state to state. Florida and California don’t require assortment of gross sales taxes on SaaS subscriptions. However New York and Pennsylvania do.

Simply in 2020, Massachusetts reclassified SaaS charges as “private tangible property,” that means SaaS subscriptions at the moment are topic to gross sales taxes throughout the state.

In our interviews, Rachel affords different examples of how tax legal guidelines are altering for SaaS corporations around the globe:

“We’re seeing, throughout the globe, nations creating guidelines that particularly goal non-resident companies offering digital items and companies. Some can have a threshold of gross sales, a few of them say each greenback is taxable.”

5. International Consumption Taxes Hold Getting Extra Sophisticated

New tax mandates are being handed that immediately affect SaaS. Very quickly, in nations around the globe, SaaS corporations working digital platforms could also be required to report all sellers utilizing their platform.

Why are tax legal guidelines getting extra difficult?

International locations know they’re dropping tax income on digital gross sales that software program corporations aren’t disclosing.

In consequence, they’re discovering new methods to trace the move of cash of their state or nation and implement assortment.

The 4 Methods SaaS Corporations Can Handle Gross sales Taxes and VAT

So how do SaaS corporations work out all of the taxes they should withhold and remit around the globe?

There are 4 approaches that we see SaaS corporations take to satisfy their obligations for transaction-related taxes:

1. Ignore It

As we’ve described on this article, ignoring gross sales taxes is a quite common strategy — but one that may go away your organization responsible for years of again taxes, charges, and penalties. The times the place this strategy can work is shrinking. As on-line commerce continues to develop, so does the drive and skill to control it.

2. Do It Themselves

Doing taxes by yourself is an effective possibility for bigger corporations with the sources to handle it successfully with an in-house staff.

Nevertheless it’s not as simple as plugging an automatic tax instrument into your gross sales platform.

SaaS corporations additionally want to consider:

- Ensuring your knowledge is clear and accessible.

- Understanding what’s taxable and the charges to cost.

- Monitoring tax thresholds to know the place you’ll must remit taxes and file tax returns.

- Remitting the right quantities and submitting returns on time for all tax jurisdictions the place you might have an obligation. This may be month-to-month, quarterly, or yearly.

- Conserving updated about altering tax legal guidelines and rules.

- Responding to notices and inquiries from tax authorities. Are they phishing, or is it actionable?

This may be burdensome for a finance division with out technical experience and trigger resentment and turnover.

3. Rent an Accounting Agency

Once you outsource your taxes, there are fewer inner sources wanted, nevertheless it’s going to price extra. And fairly than a personalized strategy, hiring an accounting agency often means they’ll take a conservative strategy with most compliance — even in the event you would like one thing extra personalized.

There’s a perspective that actually solely an in-house tax knowledgeable can present — one which requires understanding the enterprise, its methods, tax legal guidelines, and the way all of them intersect.

4. Use a Service provider of File (MoR) and Outsource the Legal responsibility

A service provider of file is a strong gross sales strategy that may reduce the pressure on firm sources and funds.

At FastSpring, we act because the service provider of file for all transactions in your website, making us accountable for accumulating and remitting taxes in your behalf. Whether or not you’re making an attempt to handle diminished tax charges, personalized taxation, tax-exempt transactions, B2C or B2B — the whole lot is dealt with for you.

A service provider of file can be at your facet if any tax audits or inquiries come up. If an audit occurs, we intervene and take the lead — so you’ll be able to keep targeted on constructing and rising your SaaS enterprise.

What’s the Greatest Resolution for Your Firm?

Possibly that is all overwhelming, however the worst factor you are able to do is nothing.

As Rachel put it, “I can by no means promise that you’ll or received’t get audited. What I can promise is that small actions now can set you up for a a lot brighter future.”

To determine what’s finest on your firm, she recommends assessing your sources and your choices.

“It’s actually realizing the enterprise, your footprint, international tax legal guidelines (duh), and what dangers you might be prepared to tackle.”

As a service provider of file, FastSpring collects and remits taxes in your behalf, so that you by no means have to fret about it. Study extra about our tax companies.