Margin Safe Lending fails to offer possession or govt info on its web site.

Margin Safe Lending fails to offer possession or govt info on its web site.

Margin Safe Lending’s web site area (“marginsl.com”), was privately registered on April nineteenth, 2023.

On its web site, Margin Safe Lending claims to be

Asia primarily based and offers with International contributors.

Margin Safe Lending’s official FaceBook group is adminned by “Hu Ming”, a just lately created dummy account.

If we have a look at Margin Safe Lending’s presentation properties, we study the creator is Panashe Alphonce Chigodora.

If we have a look at Margin Safe Lending’s presentation properties, we study the creator is Panashe Alphonce Chigodora.

Chigodora is a “crypto fanatic” from Africa.

Based on his FaceBook profile, Chigodora is initially from Zimbabwe however lives in South Africa.

This tracks with the vast majority of Margin Safe Lending promoters showing to be from Africa.

As at all times, if an MLM firm shouldn’t be overtly upfront about who’s working or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

Margin Safe Lending’s Merchandise

Margin Safe Lending has no retailable services or products.

Associates are solely in a position to market Margin Safe Lending affiliate membership itself.

Margin Safe Lending’s Compensation Plan

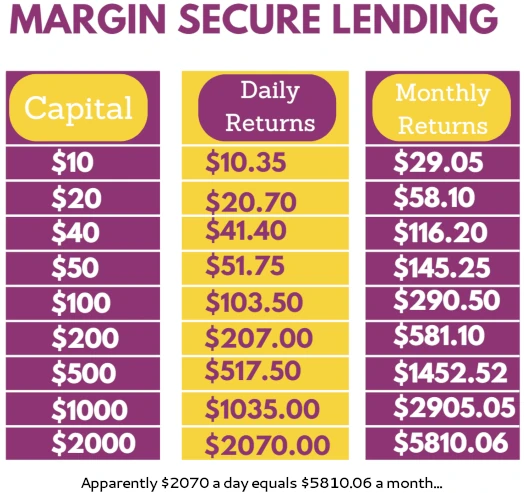

Margin Safe Lending associates make investments $10 or extra in tether (USDT). That is performed on the promise of an “as much as” 3.5% day by day return.

Margin Safe Lending pays referral commissions on invested tether down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 15%

- degree 2 – 7%

- degree 3 – 3%

Becoming a member of Margin Safe Lending

Margin Safe Lending affiliate membership is free.

Full participation within the connected earnings alternative requires a minimal $30 funding in tether.

Margin Safe Lending Conclusion

Margin Safe Lending claims to generate exterior income by way of “blockchain lending”.

MSL is a blockchain lending platform that gives a safe and clear lending expertise.

The ruse is Margin Safe Lending generates charges from lent out crypto, which is used to fund returns.

There isn’t a proof of Margin Safe Lending being engaged in lending, or every other supply of exterior income.

Moreover, Margin Safe Lending’s enterprise mannequin fails the Ponzi logic take a look at.

If Margin Safe Lending was already lending out crypto and producing 3.5% a day, what do they want your cash for?

Because it stands the one verifiable income getting into Margin Safe Lending is newly invested funds.

Utilizing newly invested fund to pay an “as much as” 3.5% day by day return makes Margin Safe Lending a Ponzi scheme.

With nothing marketed or offered to retail clients, referral commissions on invested funds provides a further pyramid layer to the scheme.

Margin Safe Lending’s fraudulent enterprise mannequin is punctuated by Panashe Chigodora being your typical crypto bro.

Behind Panashe Chigodora you have got the same old string of failed crypto initiatives and shitcoin plugs. Him hiding his involvement in Margin Safe Lending casts additional doubt on the corporate’s claims.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve Margin Safe Lending of ROI income, finally prompting a collapse.

The mathematics behind Ponzi schemes ensures that once they collapse, the vast majority of contributors lose cash.