MetFi fails to offer firm possession or govt data on its web site. Official MetFi advertising and marketing movies are dubbed over with robo voices.

MetFi fails to offer firm possession or govt data on its web site. Official MetFi advertising and marketing movies are dubbed over with robo voices.

MetFi’s web site area (“metfi.io”), was first registered in March 2021. The non-public registration was final up to date on March twelfth, 2022.

Given the Might twenty first 2022 launch date cited on MetFi’s whitepaper, it’s protected to imagine the present proprietor(s) took possession of the area in March.

Regardless of representations no one is operating MetFi, MetFi’s proprietor(s) talk to buyers via a Discord chat group.

As all the time, if an MLM firm is just not brazenly upfront about who’s operating or owns it, suppose lengthy and onerous about becoming a member of and/or handing over any cash.

MetFi’s Merchandise

MetFi has no retailable services or products.

Associates are solely in a position to market MetFi affiliate membership itself.

MetFi’s Compensation Plan

MetFi runs a ten-tier funding scheme in Binance USD (BUSD).

BUSD is a stablecoin represented to be pegged to the USD, i.e. 1 BUSD = $1 USD.

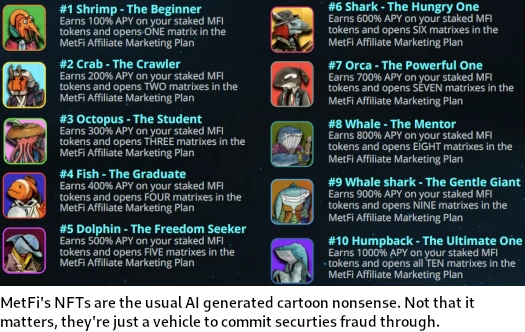

MetFi’s ten funding tiers are:

- Shrimp – 100 BUSD

- Crab – 200 BUSD

- Octopus – 400 BUSD

- Fish – 800 BUSD

- Dolphin – 1600 BUSD

- Shark – 3200 BUSD

- Orca – 6400 BUSD

- Whale – 12,800 BUSD

- Whale Shark – 25,600 BUSD

- Humpback – 51,200 BUSD

These tiers correspond with NFT funding positions.

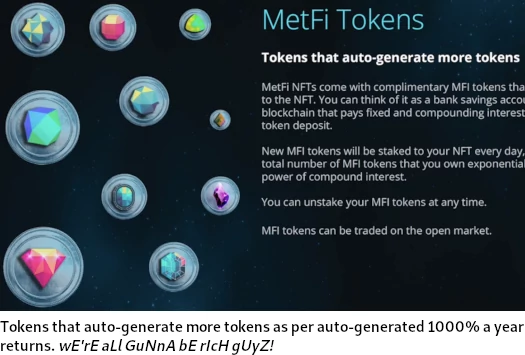

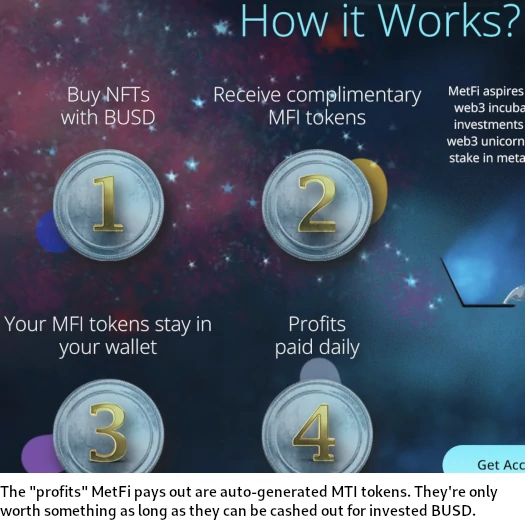

When a MetFi affiliate invests, they obtain a set quantity of MFI tokens. MFI tokens are then parked with MetFi on the promise of an annual ROI, calculated and paid every day.

- make investments on the Shrimp tier and obtain $10 value of MFI tokens, invested on the promise of a 100% annual ROI

- make investments on the Crab tier and obtain $20 value of MFI tokens, invested on the promise of a 200% annual ROI

- make investments on the Octopus tier and obtain $40 value of MFI tokens, invested on the promise a 300% annual ROI

- make investments on the Fish tier and obtain $80 value of MFI tokens, invested on the promise of a 400% annual ROI

- make investments on the Dolphin tier and obtain $160 value of MFI tokens, invested on the promise of a 500% annual ROI

- make investments on the Shark tier and obtain $320 value of MFI tokens, invested on the promise of a 600% annual ROI

- make investments on the Orca tier and obtain $640 value of MFI tokens, invested on the promise of a 700% annual ROI

- make investments on the Whale tier and obtain $1280 value of MFI tokens, invested on the promise of an 800% annual ROI

- make investments on the Whale Shark tier and obtain $2560 value of MFI tokens, invested on the promise of a 900% annual ROI

- make investments on the Humpback tier and obtain $10,230 value of MFI tokens, invested on the promise of a 1000% annual ROI

Word that MetFi don’t publish the present inner MTI buying and selling worth on their web site.

The MLM facet of MetFi pays on recruitment of affiliate buyers. Though not explicitly clarified, it’s assumed all commissions and bonuses are paid in MTI tokens.

Quick Begin Rewards

Quick Begin Rewards are paid out throughout a newly recruited affiliate’s first thirty days.

To qualify for Quick Begin Rewards, a MetFi affiliate should recruit not less than 5 associates who’ve invested at tier 4 or greater (Fish Tier).

As soon as that situation is glad, and if an affiliate continues to be inside their first thirty day interval, they obtain a ten% Quick Begin Reward on all BUSD invested by personally recruited associates.

Residual Commissions

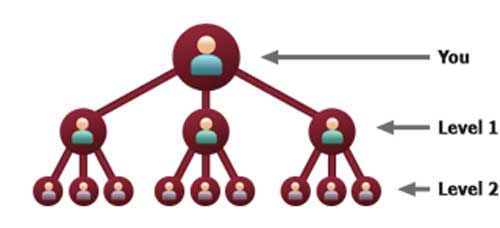

MetFi pays residual commissions through a 3×10 matrix.

A 3×10 matrix locations an affiliate on the high of a matrix, with three positions immediately underneath them:

These three positions kind the primary degree of the matrix. The second degree of the matrix is generated by splitting every of those three positions into one other three positions every (9 positions).

Ranges three to 10 of the matrix are generated in the identical method, with every new degree housing thrice as many positions because the earlier degree.

Every MetFi funding tier corresponds to its personal 3×10 matrix tier, leading to ten 3×10 matrix tiers in complete.

Positions in every matrix are stuffed through direct and oblique recruitment of associates who’ve invested in that specific funding tier.

For every individual recruited right into a MetFi affiliate’s matrix (on any tier), the obtain:

- 5% of the BUSD invested; and

- 1% of any further MFI token funding made at time of BUSD funding

Word that MetFi associates solely earn on matrix tiers they’ve personally invested on.

Matching Bonus

MetFi associates earn a 50% match on residual commissions and every day ROI quantities paid to personally recruited associates.

To qualify for the Matching Bonus, a MetFi affiliate should recruit 5 associates who’ve all invested at tier 4 or greater (Fish Tier).

Becoming a member of MetFi

MetFi affiliate membership is free.

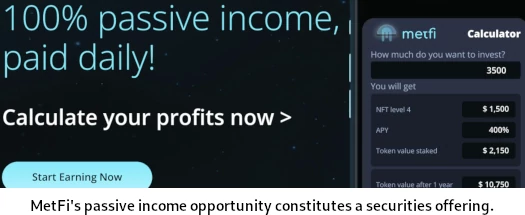

Full participation within the hooked up revenue alternative prices 102,300 BUSD ($102,300 USD equal).

MetFi Conclusion

MetFi pitches itself as a

collectible NFT ecosystem centered on incubating metaverse and Web3 unicorns and sharing the monetary returns with all MetFi NFT house owners.

As soon as the crypto bro advertising and marketing jargon is distilled, MetFi reveals itself to be a easy Ponzi hooked up to a matrix-based pyramid scheme.

The Ponzi facet of MetFi is comparatively straight ahead: You make investments BUSD, you get MTI tokens and a every day ROI is paid in your invested MTI tokens.

MetFi NFTs generate rewards each 12 hours per the staking protocol.

MetFi associates are in a position to money out so long as there’s invested BUSD left to steal.

MTI is a BEP20 token. These take 5 minutes to arrange at little to no value.

MTI tokens are generated on demand and haven’t any worth outdoors of MetFi’s Ponzi scheme.

MetFi’s pyramid scheme is as simple as its Ponzi scheme. Via a sequence of matrices, affiliate buyers are rewarded on direct and oblique recruitment of affiliate buyers.

Each elements of MetFi are fraudulent and each depend on the unsustainable fixed recruitment of recent affiliate buyers to fatten the withdrawal pot.

In an try and reassure buyers MetFi isn’t a rip-off, the scammers behind the rip-off satirically lay out their fraudulent enterprise mannequin in MetFi’s whitepaper;

The regulatory setting within the blockchain and cryptocurrency sector is loosely outlined and open to abuse by unscrupulous actors and even effectively intentioned actors that jumped in manner over their heads with different folks’s cash.

Outright scams and mission failures happen far too ceaselessly, tarnishing the fame of the blockchain and crypto sector, and giving regulators extra causes to clamp down onerous on the sector.

“Regulation of blockchain and cryptocurrency” is totally irrelevant. MetFi’s passive funding alternative constitutes a securities providing, the regulation of which provides no ambiguity.

Both MetFi and its proprietor(s) are registered with monetary regulators and offering audited monetary experiences, or they’re not and are committing securities fraud.

The rationale MetFi opts to commit securities fraud is as a result of it’s a Ponzi scheme; a fraudulent enterprise mannequin unlawful the world over.

The scammers behind MetFi additional search to reassure buyers a collapse is unimaginable, by bending the legal guidelines of arithmetic;

On June 9, 2022, MetFi locked 25,005 LP tokens to a sensible contract for five years that had been valued at roughly $2.5M on the time of locking – making MetFi rug proof for five years.

MetFi is a Ponzi scheme that may collapse when withdrawals inevitably exceed new funding. That places the rip-off within the purple, finally resulting in a collapse, or “rug pull” in crypto bro jargon.

Locking up nugatory tokens in some bullshit sensible contract doesn’t change primary rules of arithmetic.

Till recruitment dies down, anticipate unbearable gloating from MetFi crypto bros jacking off to their exponentially rising MTI token balances.

By the point they understand there’s nothing left to withdraw, it’s going to after all be too late.

The mathematics behind Ponzi schemes ensures that once they collapse, the vast majority of contributors lose cash.