Estimated learn time: 13 minutes, 7 seconds

SaaS accounting software program may help you automate:

- Recurring invoicing.

- Fee processing.

- Remitting taxes.

- Fee reconciliation.

- Fee reminders.

- Subscription administration.

- Reporting.

- Expense monitoring.

- Payroll.

- And extra …

Nevertheless, it’s virtually unimaginable to search out one accounting software program answer that satisfies all of your wants as a SaaS firm. Even software program that advertises SaaS-specific options is never an entire answer.

For instance, many accounting software program provide a approach to gather funds, nevertheless, it’s sometimes just for United States funds, not worldwide funds. If you wish to gather worldwide funds, you’ll possible want a further fee answer that focuses on world fee processing.

That’s why most SaaS corporations find yourself layering a number of level options on high of generic accounting software program to construct the answer they want.

On this information, we examine seven accounting software program choices by protecting what every one can and might’t do. Specifically, we begin with an in-depth look into the options our platform, FastSpring, offers and the way we tackle transaction and gross sales tax legal responsibility for you.

Desk of Contents

FastSpring is an end-to-end fee answer for corporations promoting digital merchandise and software-as-a-service. We show you how to collect and remit oblique tax (e.g., gross sales tax, VAT, GST), stability month-to-month transactions, ship recurring invoices and gather funds, and far more. To see how we may help you rapidly broaden globally, join a free account or request a demo as we speak.

FastSpring: Gross sales Tax, Transaction Reconciliation, Fee Processing, and Extra for Software program Corporations

FastSpring offers options for:

- Gathering and remitting U.S. gross sales tax and worldwide VAT and GST.

- International fee processing.

- Sending invoices and fee reminders.

- Reconciling transactions with success.

- Reporting.

- Far more …

However FastSpring does extra than simply present software program for just a few facets of accounting — we’re Service provider of Document (MoR) for SaaS corporations.

As your MoR, we deal with all of those duties for you. Plus, we tackle transaction legal responsibility and the duty of calculating, gathering, and remitting gross sales tax, VAT, and GST.

Within the following sections, we dig deeper into how FastSpring helps SaaS corporations broaden globally whereas simplifying accounting duties.

Observe: You will have further accounting software program for payroll, earnings tax, inside stability sheets, and so forth. FastSpring simply integrates with different options (e.g., QuickBooks) by way of extensions, webhooks, and an API.

“One of many key components [for switching to FastSpring] was the truth that FastSpring was easing our administrative burden concerning world tax and VAT administration, and the variety of invoices that we wanted to register.”

– Ovi Negrean, Co-founder and Chief Govt Officer

Totally Managed Gross sales Tax, VAT, and GST

SaaS corporations didn’t at all times need to pay gross sales tax, VAT, and GST, nevertheless, that’s not the case. Increasingly nations are passing legal guidelines that require non-resident SaaS corporations to assemble and remit some type of oblique tax. If you happen to don’t, you could face heavy fines and/or be banned from transacting in that jurisdiction.

Most accounting software program will show you how to add gross sales tax (assuming you’ve configured the choices and settings appropriately) to invoices and generate studies for remitting gross sales tax. Nevertheless, accounting software program is often insufficient for:

- Calculating and amassing VAT or GST. If you wish to transact exterior of the U.S., you’ll be utterly by yourself to calculate and remit VAT, GST, and different types of oblique tax.

- Including gross sales tax to purchases in your web site. Some accounting software program will provide a fee portal the place prospects can settle invoices. Nevertheless, that is completely separate from any checkout you might have in your web site, which implies you’ll want totally different software program for amassing oblique tax in your web site (which implies additional price and additional work).

Plus, you’re in the end held answerable for all tax legal responsibility. Sustaining tax compliance is usually extra difficult than merely amassing and remitting the correct quantity (and kind) of oblique tax on the proper instances.

For instance:

- Nations equivalent to Serbia, the UK, Taiwan, and others require digital invoicing (from resident and non-resident corporations alike), which might price corporations $2k-$5k per 12 months. Observe: E-invoicing mandates are rising at an alarming fee — the EU is rolling out common digital invoicing necessities by 2028.

- Nations equivalent to India, Indonesia, Japan, and others require your account to be “pre-funded” that means it’s important to predict the quantity of tax you’ll owe and hold that cash in your account till it’s time to remit the funds (typically as much as three months upfront).

- Nations equivalent to Colombia, Japan, Mexico, Serbia, and others require native illustration. This implies somebody with a bodily presence (often a lawyer or accountant) in that nation must be answerable for your tax legal responsibility, which might price wherever from $5k to $15k per 12 months.

- Nations equivalent to Taiwan, Indonesia, Nigeria, Vietnam, and others require you to file an earnings or income tax return when you begin amassing oblique tax, which might add as much as $5-$10k per 12 months.

That’s why most SaaS corporations find yourself hiring full-time tax accountants and specialists to deal with oblique tax.

FastSpring simplifies the complete course of and makes it very easy so as to add all types of oblique tax to invoices (and gather it at checkout) by dealing with it for you.

With over 20 years of expertise submitting 1,200+ tax returns annually in 100+ jurisdictions, our group ensures the correct quantity (and kind) of oblique tax is collected (we even deal with tax-exempt transactions within the U.S. and 0% reverse prices when relevant).

Then, our group remits these taxes for you and ensures all the mandatory procedures are in place to remain compliant. We now have long-standing relationships with tax specialists globally to remain present on regulation adjustments, enforcement updates (generally particular industries are focused), and tendencies they’re seeing with different software program corporations.

If a rustic or state approaches you about tax compliance, our group will typically offer you copy-and-paste responses.

Quote Administration and Recurring Invoicing

With most accounting software program, you’ll be able to simply handle B2B subscriptions in your web site, however not B2C transactions — which is why many corporations find yourself with two totally different options. Which means double the fee and double the work.

With FastSpring, you’ll be able to handle B2B and B2C transactions from one platform.

FastSpring offers a number of choices for establishing totally different subscription fashions equivalent to:

- Fastened, per seat, metered, tiered, and bundled billing.

- Prorated billing to accommodate upgrades and downgrades mid-cycle.

- Computerized or handbook renewal.

- Upsells, cross-sells, one-time charges, reductions, and presents.

- And far more …

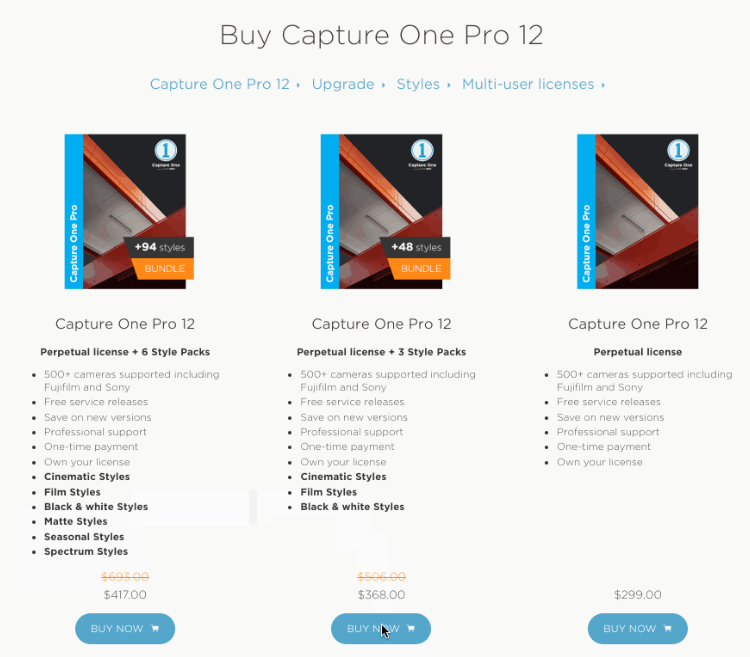

Then, you may make these merchandise accessible in your web site:

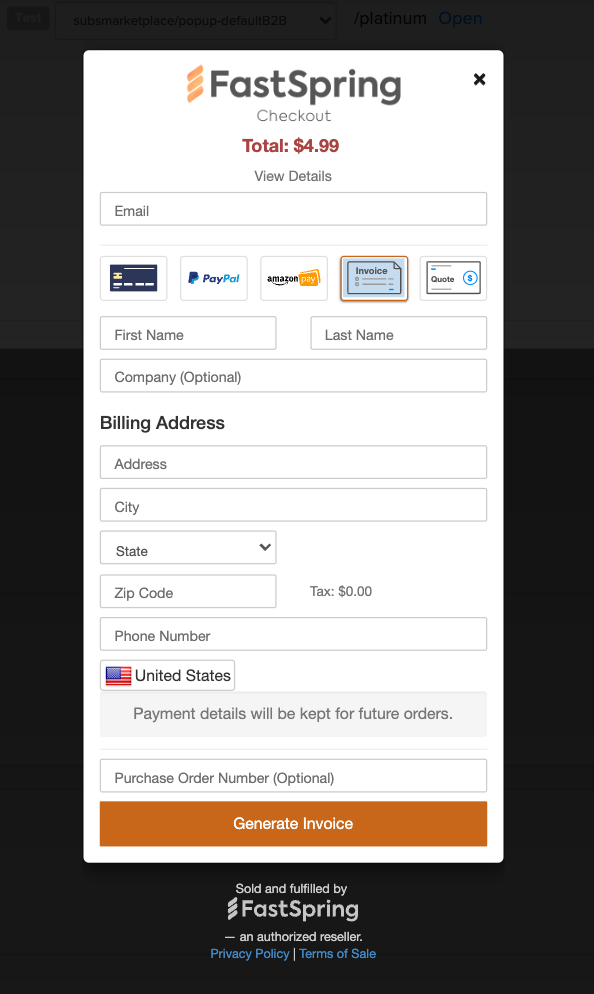

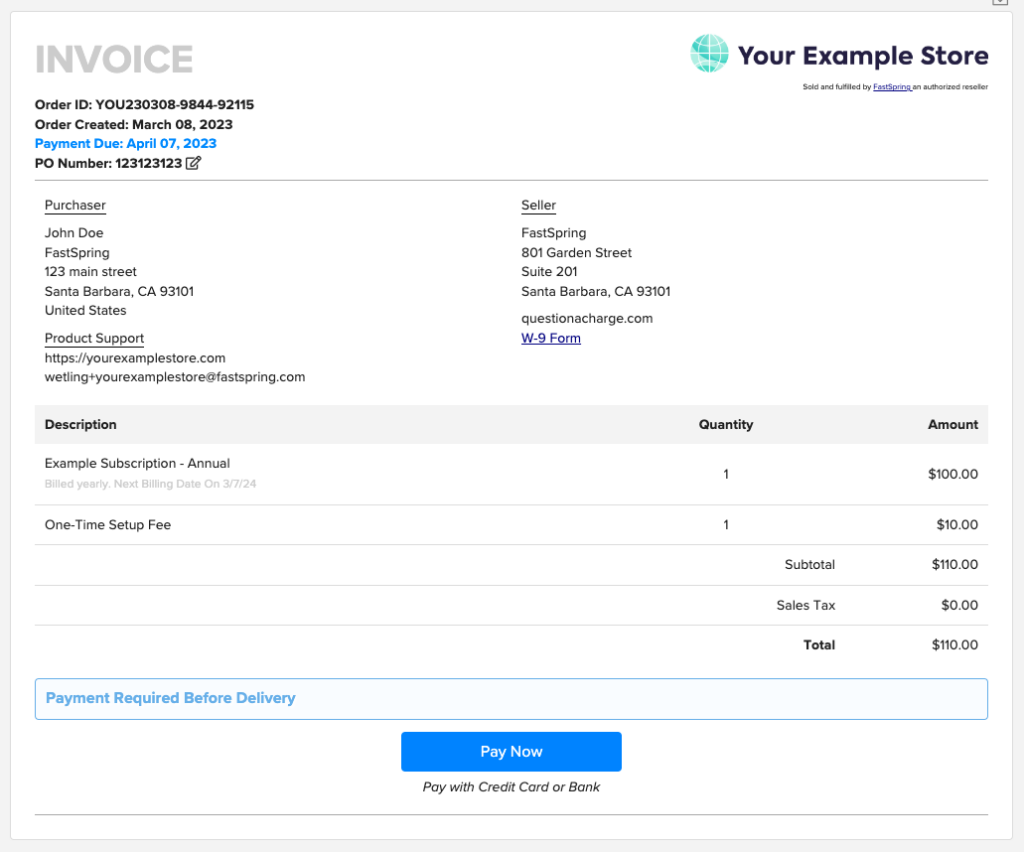

Alternatively, you’ll be able to add the merchandise to quotes and invoices utilizing FastSpring’s Digital Invoicing software. With Digital Invoicing, your group can create and handle quotes and invoices (e.g., add reductions and tags, set the expiration date, go away notes for the client, observe the acquisition course of).

You too can provide a self-serve portal the place prospects can generate their very own quotes or invoices based mostly on objects of their cart.

Worldwide Fee Processing

Most accounting software program will provide easy fee processing for transactions within the U.S., nevertheless, most solely help just a few fee sorts (e.g., Mastercard, Visa, ACH) and hardly any of them present fee processing for worldwide fee strategies or currencies. To just accept worldwide funds, you’d have to combine with and handle further fee processors.

FastSpring makes it very easy to just accept tons of most well-liked fee strategies around the globe (by way of checkout or bill) by:

- Managing a number of fee gateways for you. Every fee gateway has particular nations, fee strategies, and currencies that they help. For instance, a fee processor could help Amazon Pay in america however they gained’t course of funds from Brazil. With FastSpring, you’ll robotically have entry to a number of fee gateways focusing on worldwide transactions (and transactions in america).

- Offering forex conversions at checkout and on invoices. You possibly can set the worth for every product in every forex or let FastSpring make the conversions for you. You too can let your prospects select their most well-liked forex (and language) or let FastSpring select the suitable one based mostly on their location.

“Having many fee strategies which can be at all times related to every totally different area around the globe has helped us obtain vital progress worldwide.”

– Ovi Negrean, Co-founder and Chief Govt Officer

To pay an bill, prospects merely click on on the ‘Pay Now’ button on the backside of the bill (as proven beneath).

It will take prospects to both a popup checkout or an online storefront hosted by FastSpring, relying on what you select. Both one could be very customizable by way of the feel and appear of the checkout.

Observe: You should utilize this similar checkout in your web site, and also you’ll have the choice to embed the checkout in your webpage, should you favor. Plus, you should utilize FastSpring’s Retailer Builder Library to customise the client journey main as much as checkout (e.g., cross-sells, upsells).

Lastly, you’ll be able to configure FastSpring to ship out fee reminders two, 5, seven, fourteen, and twenty-one days after a fee technique fails. In our expertise, sending out a number of fee reminders is the easiest way to make sure ongoing fee.

Simplified Transaction and Success Reconciliation

Most accounting software program will show you how to automate the method of creating certain the funds you obtain match the orders being crammed. Although it’s automated, it may be an enormous process to confirm that the automation labored appropriately and to repair any imbalances.

Plus, worldwide transactions make it extra difficult as a result of you might have funds coming in by totally different gateways (and due to this fact totally different software program suppliers) and into a number of service provider accounts.

As MoR, FastSpring simplifies transaction reconciliation by dealing with it for you. We take the entire transactions along with your purchasers and bundle them into one or two lump sum funds which we ship to you a couple of times per 30 days.

As a substitute of spending hours balancing tons of or hundreds of transactions every month, you spend only a few minutes balancing one or two transactions from FastSpring.

You continue to have full management over your product (i.e., the way it’s bundled, the pricing mannequin, how a lot is bought, the place you wish to promote it, success, and so forth.).

Detailed Reporting for SaaS KPIs

FastSpring presents a built-in reporting characteristic that will help you discover the data it’s essential to create frequent accounting studies (e.g., breakeven report or stability sheet). Most studies will be discovered within the Income Overview dashboard or the Subscription Overview dashboard, however you too can create and save customized studies.

If you happen to don’t see the precise report you want, you’ll be able to attain out to our group and we’ll show you how to discover (or construct) the mandatory studies.

Any report will be seen in your dashboard or downloaded as a CSV, PNG, or XLSX file. You too can combine our Analytics and Reporting characteristic with third-party software program to tug in or ship out information.

Easy Flat-Fee Pricing

All facets of FastSpring can be found for one flat-rate value based mostly on the quantity of transactions you progress by our platform. And, there aren’t any upfront prices — you’ll solely be charged when a transaction takes place.

“We have been targeted on not solely discovering an ecommerce platform that labored but in addition on constructing a relationship and partnership, which I consider is essential. You don’t wish to purchase one thing after which be alone. You want a superb partnership. Ultimately, we picked FastSpring as a result of they confirmed us they wished to be a real accomplice.”

– Frederic Linfjärd, Digital Industrial Supervisor at Seize One

FastSpring is extra than simply software program for some facets of accounting — we’re your Service provider of Document. To see how we may help you rapidly broaden globally, join a free account or request a demo as we speak.

Construct Your Personal SaaS Accounting Resolution

| $ | Accounting software program for: Including gross sales tax to invoices and producing gross sales tax types. Fee processing for U.S. funds. Managing B2B transactions. Reporting. Balancing transactions. | VS. | FastSpring |

| $ | Tax software program for including gross sales tax to web site purchases | ||

| $ | Software program engineers for creating software program that provides international consumption tax to invoices and checkout | ||

| $ | Tax regulation specialists for calculating and remitting international consumption tax (e.g., VAT and GST) | ||

| $ | Worldwide fee gateways for accepting extra fee strategies and rising authorization charges | ||

| $ | Subscription administration software program for managing B2C and B2B merchandise | ||

| $ | Monetary reporting software program for SaaS analytics and reporting |

Along with FastSpring, you’ll want software program to handle issues like payroll and earnings tax. Subsequent, we’ll cowl six extra choices that present options for these areas.

6 Different Accounting Software program

1. Maxio (Previously SaaSOptics)

SaaSOptics is likely one of the most well-known instruments for monitoring SaaS metrics (e.g., month-to-month recurring income), SaaS income recognition, and SaaS expense monitoring. They not too long ago merged with Chargify (a subscription administration platform) to type Maxio.

Whereas Maxio has rather a lot to supply SaaS corporations, they don’t tackle transaction or oblique tax legal responsibility for you. Plus, you’ll want further software program for issues like accepting most well-liked fee strategies around the globe. (They do work with Avatax that will help you gather gross sales tax and VAT, however the performance is restricted).

Maxio presents options for:

- Recurring billing.

- Income administration.

- Expense amortization.

- Integrating with fee gateways.

- Analytics, reporting, and forecasting.

2. Oracle NetSuite

Oracle NetSuite is a enterprise administration suite that gives options for accounting, B2B and B2C ecommerce, ERP, CRM, and far more. They serve many various industries together with software program corporations. In addition they help all sizes of companies from SaaS startups to enterprises.

Observe: NetSuite offers single-seat entry to streamline communication between your organization and your CPA.

NetSuite contains options for:

- Monetary reporting.

- Income recognition.

- Automated normal ledger spreadsheets.

- Tax reporting.

- Income administration.

- Mission planning and budgeting.

3. QuickBooks

QuickBooks by Intuit is a well-liked accounting answer for small to midsize companies and startups. They provide an on-premise and a cloud-based model (known as Quickbooks On-line).

QuickBooks wasn’t particularly designed for SaaS corporations. As a substitute, QuickBooks recommends SaaS corporations combine with SaaSOptics to get the metrics and functionalities they want.

QuickBooks presents:

- Payroll administration instruments.

- Accounts receivable and payable instruments.

- Time monitoring instruments.

- Instruments for maximizing tax deductions.

- Digital bookkeepers that may show you how to with easy accounting duties.

- Fee processing on-line or in individual for some debit and bank cards, ACH, Apple Pay, PayPal and Venmo.

- Actual-time enterprise studies (e.g., revenue and loss statements, money circulate statements)

4. FreshBooks

FreshBooks presents accounting instruments to freelancers and firms with a number of staff or contractors. They serve a number of industries together with expertise, building, accounting and extra. They cost you based mostly on what number of billing purchasers you will have that month beginning with 5 billing purchasers as much as limitless purchasers.

Freshbooks presents:

- Fee processing for MasterCard, Visa, Apple Pay, Uncover and ACH.

- Mission estimations and administration.

- Mileage and time monitoring.

- Payroll.

- Bookkeeping.

- Invoicing.

- Reporting.

5. Stripe

Stripe is a fee processor that may be built-in along with your accounting software program options that will help you settle for and handle funds. Though their platform focuses on getting buyer funds into your checking account, they do provide just a few accounting-related companies equivalent to income recognition.

Stripe serves many various industries, together with SaaS, at many various phases of progress, together with early-stage startups. Nevertheless, on this article on Stripe options, we focus on why Stripe will not be the only option for SaaS corporations. In brief, corporations that select Stripe as their fee platform typically find yourself with a big software program stack to handle.

Stripe offers options for:

- Your web site checkout.

- Gathering gross sales tax at checkout.

- Fraud and danger administration.

- Recurring invoicing and subscriptions.

- Knowledge warehouse administration.

- In-person funds.

6. Xero

Xero is an accounting system for small companies, accountants, and bookkeepers. Xero is one other software program that doesn’t straight serve SaaS companies, and as a substitute presents an integration with SaaSOptics.

Xero’s options embrace:

- Accounts payable and money circulate automation.

- Spend administration and reimbursements.

- A number of checking account integrations.

- On-line invoicing and funds.

- Payroll.

- Mission administration.

FastSpring handles worldwide oblique tax, fee processing, digital invoicing, subscription administration, dunning, and far more for you. Join a free account or request a demo as we speak.