Estimated learn time: quarter-hour, 0 seconds

Chargebee is a strong subscription administration platform. Nevertheless, there are particular points of amassing recurring funds that you’d nonetheless be answerable for when utilizing Chargebee, corresponding to:

- Connecting to fee gateways manually. Whereas Chargebee helps a number of totally different fee gateways, it’s important to arrange and configure every one.

- Remitting taxes on the finish of the 12 months. They may acquire taxes for you, however you’re finally held answerable for submitting taxes accurately with every state, province, nation, and many others.

- Reconciling funds, achievement, refunds, and many others. Whereas Chargebee permits you to automate many mundane accounting duties and combine with account software program, you continue to have to trace and report each transaction, refund, and many others.

- Responding to and processing chargebacks. They may notify you when a chargeback happens, however it’s important to determine the following steps to take.

On this information, we current eight options to Chargebee that assist relieve a few of these burdens for customers, beginning with an in-depth evaluate of our answer, FastSpring.

Chargebee options on this checklist:

FastSpring handles the complete fee course of from checkout to remitting end-of-year taxes for SaaS firms. To be taught extra about how FastSpring may also help you scale rapidly, join a free account or request a demo at present.

FastSpring: Takes on Accountability for Cost Processing, Remitting Taxes, and Extra for SaaS Companies

Most Chargebee options are both subscription billing software program or fee gateways. A lot of these suppliers could possibly show you how to hook up with worldwide fee gateways, provide you with a warning to chargebacks, and show you how to collect consumption tax. Nevertheless, you’ll nonetheless be answerable for paying taxes, processing chargebacks, and for issues like authorized compliance, dunning, and extra.

FastSpring, alternatively, handles all the things from optimizing your checkout movement to remitting end-of-year consumption tax by performing as your Service provider of Document (MoR). Subsequent, we clarify how a MoR is totally different from different fee service suppliers.

What It Means to Have FastSpring as Your Service provider of Document

A Service provider of Document (MoR) is the enterprise entity that sells items or companies to the client. You may act as your personal MoR or you possibly can outsource the complete course of to FastSpring. Firms that haven’t thought of who their MoR is are successfully performing as their very own MoR.

While you outsource your transactions to FastSpring, your clients nonetheless go to your web site to decide on their software program and subscription however FastSpring takes over when the shopper goes to checkout. They’ll obtain a receipt from FastSpring, and FastSpring shall be listed on their financial institution or bank card assertion. All income is yours, however FastSpring is the liable get together for the sale.

That’s why FastSpring can do greater than different service fee suppliers and may…

- Collect and remit consumption tax

- Adjust to native legal guidelines and laws

- Course of chargebacks

- Reconcile transactions, funds, refunds, and many others.

- And extra…

… for you.

If one thing goes mistaken with taxes, native compliance, chargebacks, accounts not balancing, and many others., FastSpring takes the result in clear up the difficulty in your behalf.

As a substitute of juggling a number of platforms and suppliers for a whole fee answer, you possibly can work with only one supplier — FastSpring.

Plus, you can begin promoting in 200+ areas nearly immediately as a result of we’ve already established the mandatory processes in every area. You may be taught extra about how FastSpring helps you with worldwide recurring funds, right here.

Within the subsequent sections, we’ll dive deeper into how FastSpring helps you:

We’ll additionally cowl how FastSpring gives all options for one flat-rate worth designed to suit your funds.

Create Versatile Free Trials and Recurring Billing Logic With out Code

Not each enterprise can use the identical free trial mannequin. Some companies will see extra success in the event that they let clients join with out fee particulars whereas others will see extra success in the event that they require a fee technique to enroll however don’t robotically cost the shopper on the finish of the trial. Moreover, what labored for your corporation to begin is probably not the correct answer for you long run. That’s why most SaaS firms want fee software program that may assist many various kinds of trial fashions, subscriptions, and many others.

Nevertheless, many fee processors solely provide restricted recurring billing and trial choices. This makes it troublesome to optimize your trials and subscription plans for prime conversions. It additionally makes it troublesome to adapt as a enterprise in the long term.

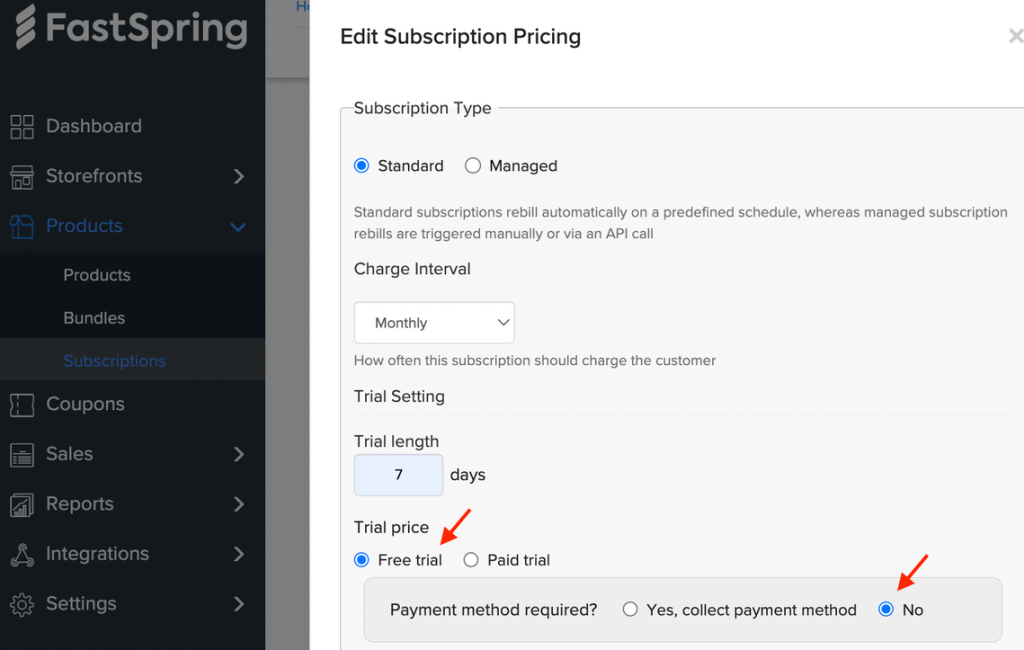

FastSpring, alternatively, delivers all kinds of choices for how one can arrange trials, subscriptions, and extra. Beneath, we offer an summary of FastSpring’s subscription administration instruments.

Trial subscription choices:

- Set any size of trials

- Arrange free, paid, or usage-based trials

- Select whether or not or to not require a fee technique when signing up for a trial

- Select to robotically invoice the person after the trial has ended or allow them to manually begin a paid subscription

- Enable subscribers to reactivate expired trial accounts

- Select when FastSpring will ship reminders of ending trials (e.g., three days earlier than the trial ends)

- Provide a reduced trial interval

- Mechanically detect when a single person tries to enroll in a number of trials and solely enable one trial account

- And extra

Recurring billing choices:

- Select subscription frequency and billing date (or let your clients select)

- Set subscriptions to auto-renewal, guide renewal (i.e., clients need to re-enter fee data every time they’re billed), or managed renewal (i.e., your group initiates the cost by way of the API which is nice for usage-based billing)

- Provide reductions and coupons

- Enable prorated billing if a buyer needs to improve, downgrade, or pause the service part-way via the billing cycle

- Add one time purchases to preliminary invoice however not recurring billings

- Handle upsell and cross-sell merchandise at checkout

- Give clients the choice of whether or not or to not retailer fee data (or make the choice for all clients)

- Auto-renew to a special subscription

- Provide subscription add-ons

- And extra

Success choices:

- Select whether or not to share merchandise and sources by way of a license key, product obtain, signed PDF, or e mail

- Configure a number of achievement actions for one subscription (e.g., ship a license key and product guide PDF by way of e mail)

FastSpring additionally gives your clients with a self-serve portal the place they will improve, downgrade, or pause their subscriptions. This self-serve portal is solely managed by FastSpring however displays the visible branding of your checkout for a cohesive buyer expertise.

Lastly, some subscription administration instruments require a whole lot of technical expertise to arrange and use. FastSpring permits you to arrange lots of the choices talked about above with out code. In case you have distinctive subscription administration wants, you can too use our API and webhooks library for extra management.

Notice: If you have already got a number of subscriptions arrange in one other platform, we may also help you simply migrate over to FastSpring. For subscription information migration with fee data included, click on right here for more information. For subscription information migration with out fee data, click on right here for more information.

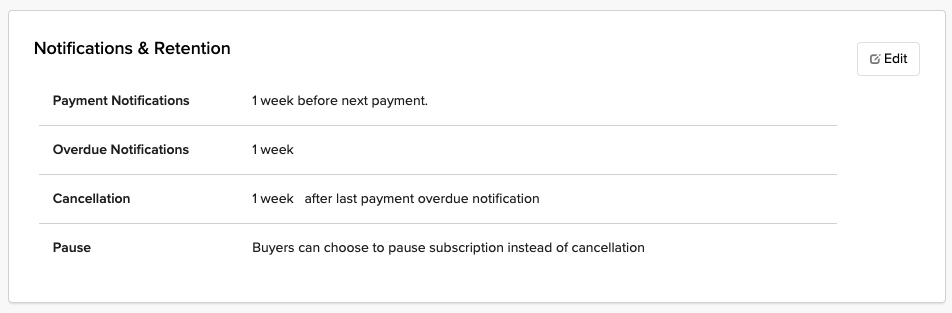

Decrease Cost Failures with Superior Cost Routing and Good Dunning

From the preliminary buy to every subsequent rebill, failed fee is likely one of the fundamental causes for misplaced income. Many fee service suppliers will robotically retry failed funds as soon as or notify clients of failed funds. This can be a good place to begin, however there are extra methods to cut back churn as a consequence of failed funds.

FastSpring helps you proactively reduce fee failures and scale back churn with:

- Proactive notifications (e.g., ‘your bank card is expiring quickly’)

- A number of follow-up notifications (e.g., two, 5, seven, fourteen, and twenty-one days after their fee technique fails)

- A number of fee retries earlier than every follow-up notification is distributed out

- Automated fee gateway rerouting (this solves many fee failures as a consequence of community or system errors)

- Intuitive self-serve portal (clients can simply replace fee data from the identical portal the place they handle their subscription plan)

Plus, you possibly can select whether or not to pause or proceed the service when a fee fails. If you happen to preserve the service going after a failed fee and provides your clients an opportunity to replace their fee data, you’ll have much less churn.

It’s also possible to select to pause slightly than cancel their service in spite of everything reminders have been despatched out. This makes it simpler on your buyer to restart their subscription with out the effort of onboarding once more.

You may learn extra about how one in all our clients decreased churn by 50% on this case examine.

Enhance Conversions with a Branded, Localized Checkout

Friction on the buy step could cause clients to fall off earlier than finishing a purchase order. For instance:

- If the value at checkout is totally different than it was on the web site (e.g., totally different foreign money or totally different quantity as a result of extra charges have been added with no clear label), clients might determine to not purchase.

- If the checkout is visually very totally different from the web site or if the checkout is on a wholly totally different web site, the shopper is much less more likely to imagine the checkout is genuine and safe.

These are simply two examples however there are numerous explanation why a buyer might determine towards finishing a purchase order on the final minute. FastSpring helps you anticipate objections and scale back friction at checkout within the following methods:

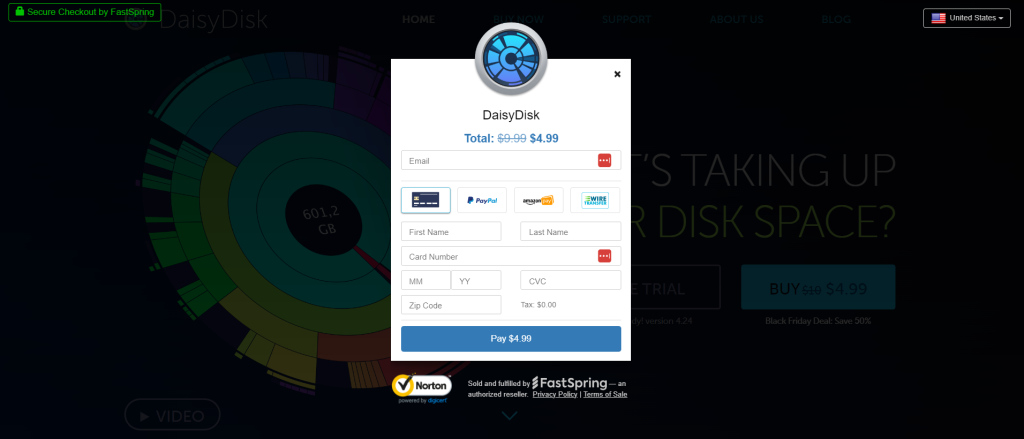

Customizable Checkout UI

Most subscription administration platforms or fee processors solely present checkout templates the place you possibly can add your brand and select primary shade schemes. These options not often actually match your visible branding and is probably not optimized for rising conversions. To create the very best expertise for your clients and get the best conversion charges, you want extra customized skills.

FastSpring permits you to customise the appear and feel of your checkout with pre-built branding instruments and CSS overrides. We additionally present a Retailer Builder Library that provides you in depth flexibility over how your checkout seems and operates. This lets you create the checkout expertise that the majority aligns together with your model and highlights your product.

Most well-liked Cost Strategies

One of many greatest causes clients fail to finish a purchase order is as a result of they will’t use their most popular fee technique. Nevertheless, providing totally different fee strategies isn’t so simple as including their brand to your checkout display. You need to conform to sure phrases and situations earlier than a card community or issuing financial institution will approve transactions with your corporation. Every fee supplier can have totally different laws concerning fraud, chargebacks, privateness safety, and many others. It may be an enormous job to remain in good standing with many alternative fee suppliers by yourself.

If you wish to transact internationally, there shall be much more to handle. Whereas Visa and Mastercard could also be fashionable fee strategies within the U.S., patrons in different international locations desire totally different fee strategies. To transform worldwide clients, it’s worthwhile to present many various kinds of most popular fee strategies — which suggests extra fee suppliers to keep up.

FastSpring takes care of all of this — from staying in good standing with card networks to managing fraud and chargebacks — for you. FastSpring already has good relationships with many alternative card networks and issuing banks world wide, which suggests you possibly can settle for your clients’ most popular fee strategies immediately.

Native Foreign money Conversions and Language Translations

Clients usually tend to belief a checkout expertise that makes use of the identical language and foreign money as what’s proven in your web site. That’s why FastSpring permits you to translate checkout into the native language and convert costs to the native foreign money.

You may let every purchaser choose their most popular language from a dropdown menu. Or, you possibly can lock the language and FastSpring will robotically choose the suitable language based mostly on the client’s location.

You even have the choice to set a customized worth in every foreign money or let FastSpring robotically convert costs to the native foreign money. FastSpring makes use of OANDA for trade charges and we replace costs 4 instances per day. (Contact our gross sales group for data on markup charges.)

If you happen to select to let FastSpring convert product costs for you, we match the format of the unique worth. For instance, if the unique worth is $12.99 and the conversion to Euros is €14.29, FastSpring would change it to €14.99.

You may learn the way Nelio elevated progress by 50% with localized checkout, on this case examine.

Embedded Checkout, Pop-up Checkout, or Internet Storefront

With FastSpring, you possibly can embed checkout instantly in your webpage, which ensures much less disruption and reduces the chance of your patrons abandoning.

It’s also possible to select to implement a pop-up checkout which requires much less setup (merely insert a couple of strains of pre-written HTML and Javascript in your webpage).

You may learn the way DaisyDisk was in a position to spend much less time managing their checkout whereas considerably rising conversions by utilizing FastSpring’s pop-up checkout, on this case examine.

Lastly, if you wish to outsource the complete checkout course of to FastSpring, you possibly can select to make use of the online storefront choice. Clients shall be redirected to a webpage solely managed by FastSpring the place they will view their cart and full the acquisition. This internet storefront shall be custom-made to match your visible model identification.

Customized Developer Assist

Many fee service suppliers will solely show you how to with the preliminary setup and when one thing goes mistaken with the software program. This leaves you by yourself to handle ongoing fee operations.

FastSpring is devoted to offering you with the very best expertise all through the complete engagement. Our pleasant assist group will show you how to discover and construct out the very best options for your corporation — no matter how large or small your operation is.

All-in-One Pricing With out the Want for Further Software program

Chargebee separates options into three plans, so it’s possible you’ll ultimately want the costliest plan to get the options you want. For instance, chargeback automation is barely supplied in Chargebee’s costliest plan.

Plus, you’ll nonetheless need to pay for added software program options like fee gateways or tax software program for a whole fee administration system (and the workers to handle all of it).

FastSpring, alternatively, gives one flat-rate worth that features all companies and options. Our group works with you to seek out an reasonably priced worth based mostly on the quantity of transactions you progress via FastSpring. You’ll solely be charged when transactions happen and also you gained’t be charged migration charges.

If you happen to assume FastSpring might be the correct fee answer on your subscription enterprise, join a free account or request a demo at present.

7 Different Chargebee Alternate options

1. Stripe

Stripe’s fundamental service is fee processing, nevertheless, they do provide a couple of different companies corresponding to:

- Checkout

- Fraud and danger administration

- On-line invoicing

- In-person funds

- Subscription administration

- Digital and bodily card issuing

- Enterprise spend administration

Stripe billing has fewer choices than Chargebee for recurring billing, however you possibly can simply combine the 2 software program. Stripe works with firms of all sizes from startups to massive enterprises.

2. Maxio

Maxio (previously Chargify and SaasOptics) is a monetary operations platform for B2B SaaS. They provide options to automate monetary techniques on the back-end and options to assist enhance the order-to-revenue course of. Their fundamental companies embrace:

- Subscription administration

- Utilization-based and world billing

- Income recognition and income administration instruments

- Billing system analytics and metrics

- Constructed-in integrations with numerous different software program (e.g., accounting software program like QuickBooks and Xero)

- Worldwide fee gateways

Maxio advertises their capacity to accommodate any go-to-market technique (i.e., product-led or sales-led).

3. Zoho Subscriptions

Zoho gives a big suite of software program to run your corporation from a CRM and ERPs to a video assembly platform. Zoho Subscriptions is their fee processing and recurring billing answer. A few of their key options embrace:

- Tax compliant invoicing

- Multi-currency conversions

- Bill templates

- 30+ pre-built analytic stories

- Automated on-line fee retries

- Out-of-the-box integrations with different billing platforms (e.g., Stripe, PayPal, and many others.)

Zoho Subscriptions gives extra pre-made options than different choices on this checklist, which some firms might discover limiting. Nevertheless, Zoho Subscriptions could also be a sensible choice if you happen to’re already utilizing different Zoho instruments.

4. Fusebill

Fusebill integrates with Stax Invoice to offer you subscription administration software program and a fee gateway in a single platform. Aside from providing a fee gateway with every plan, Fusebill gives lots of the similar options as Chargebee together with:

- Dunning administration

- Versatile recurring billing choices

- Recurring income recognition software program

- Billing analytics

- Tax calculation

Fusebill additionally gives versatile catalog pricing and stock monitoring instruments.

5. Zuora

Zuora is a monetization platform for B2C and B2B firms. Zuora’s key functionalities embrace:

- Buyer subscription administration

- Income reconciliation instruments

- Income analytics

- Constructed-in integrations with a lot of enterprise software program

- Low-code SDKs and APIs to construct your personal integrations

- Quoting software program

Zuora gives a whole lot of flexibility for constructing out your personal answer on high of their platform, nevertheless, non-developers might discover it troublesome to handle.

6. Sticky.io

Sticky.io is a subscription administration platform that integrates with fashionable ecommerce platforms like Salesforce Commerce Cloud, BigCommerce, and Shopify. They promote the power to:

- Assist practically any subscription or pricing mannequin

- Create coupons, reductions, and particular promotions

- Provide add-ons, upsells, and many others.

- Battle fraud and chargebacks

- Handle automated dunning

Like Chargebee, Sticky.io doesn’t present a fee gateway, nevertheless, they do provide pre-built integrations with a number of fee gateways.

7. Braintree

Braintree by PayPal is a fee gateway supplier that additionally gives service provider accounts. Braintree choices embrace:

- Subscription billing administration

- Optimized checkout movement

- Versatile danger mitigation choices

- Reporting and analytics

- Third-party integrations for recurring billing, accounting, and extra

Braintree helps fee from PayPal, Venmo (within the US), Apple Pay, and Google Pay.

As a substitute of managing a big software program stack, let FastSpring deal with the complete fee lifecycle for you. FastSpring is greater than a subscription administration platform — we’re the Service provider of Document for world SaaS firms. Join a free account or request a demo at present.