Alibaba’s income mannequin has enabled them to turn out to be not solely China’s main e-commerce firm but additionally a distinguished participant within the world market. This text will dissect Alibaba income mannequin, discover its totally different income streams, and delve into its development and success.

Alibaba’s Enterprise choices

Alibaba’s enterprise mannequin is structured round totally different segments as a part of their numerous product and repair choices. These segments serve totally different markets and have totally different monetization methods.

Alibaba

Alibaba.com is the corporate’s business-to-business (B2B) platform that connects consumers and suppliers globally. This platform primarily caters to giant companies concerned in substantial buying and selling by way of amount and worth. Alibaba.com has been significantly useful in offering Chinese language producers and suppliers with a platform to promote their services internationally.

The corporate additionally supplies extra companies alongside the provision chain for imports and exports, corresponding to customs clearance, VAT refund, commerce financing, and logistics. As well as, they will pay for premium choices like boosted web site visibility and an infinite variety of product listings.

Taobao

Thought to be the jewel in Alibaba’s crown, Taobao is the corporate’s most intensive web site. This consumer-to-consumer (C2C) platform facilitates small entrepreneurs in providing their merchandise to a world viewers.

On Taobao, each consumers and sellers pay no charges to make purchases or gross sales. The location operates equally to Google in that it returns outcomes based mostly on the consumer’s key phrases and that companies pay to be featured extra prominently than their opponents. Every vendor’s success charge is displayed on the positioning utilizing a singular grading system.

Tmall.com

Tmall.com serves as a portfolio of high-end manufacturers. This platform is designed for China’s prosperous center and higher courses who’re prepared to spend on top-quality merchandise.

Tmall options over 3700 product classes and has greater than 500 million month-to-month energetic customers. Tmall supplies its distributors with analytics that present info, together with site visitors, pageviews, and rankings from prospects.

In Q3 FY 2022, the ecommerce division (contains Alibaba, Taobao and Tmall) totaled $27.0 billion. Virtually 71% of the corporate’s general income and nearly all of its adjusted EBITA come from this division.

Cainiao

Cainiao is Alibaba’s home and worldwide one-stop logistics service and provide chain administration answer. This section addresses the various logistic wants of retailers and customers.

The Cainiao division noticed a 15.1% YoY development in income to $2.1 billion in Q3 FY 2022. An adjusted EBITA lack of $14 million was recorded for the division, which is a lower of greater than two and a half occasions from the adjusted EBITA loss reported for a similar quarter a yr in the past. Greater than 5% of complete company income comes from this division.

Cloud Computing

Alibaba’s cloud section, Alibaba Cloud, presents a whole suite of cloud companies globally, together with database, storage, community virtualization, safety, administration and utility, huge knowledge analytics, and different companies.

The cloud division’s Q3 FY 2022 gross sales of $3.1 billion was up 20.4% year-over-year. After reporting a deficit in the identical statistic a yr in the past, it earned a revenue of $21 million this time round. About 8% of general gross sales and a minor proportion of adjusted EBITA comes from this division.

Alibaba Monetization strategies

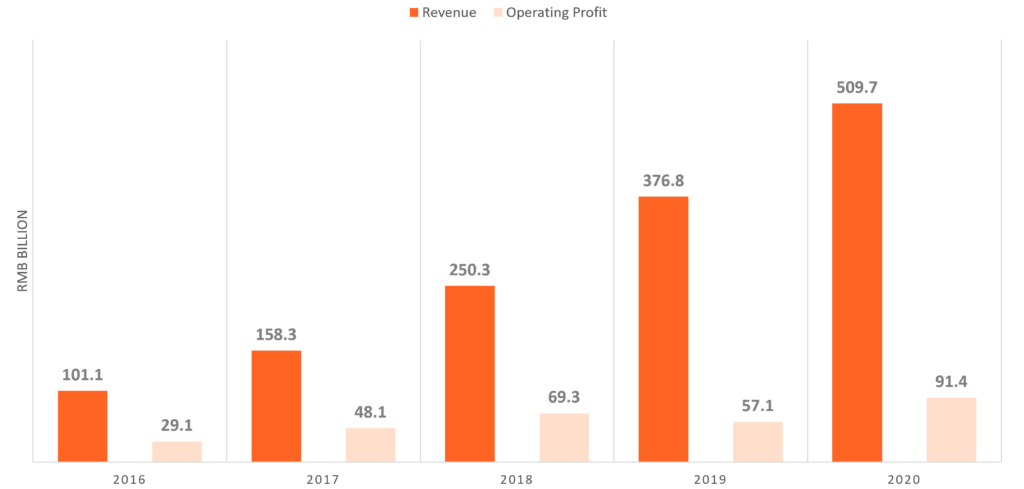

Alibaba’s monetary outcomes have proven a mixture of development and challenges. For example, within the third quarter of the 2022 fiscal yr, the corporate reported a 9.7% YoY rise in income to $38.1 billion. Nevertheless, its internet revenue attributable to atypical shareholders fell by 74.3% to $3.2 billion throughout the identical interval.

Alibaba’s enterprise mannequin generates income primarily from three avenues: on-line advertising companies, commissions on transactions, and membership and value-added companies.

On-line Advertising and marketing Providers

Alibaba presents varied on-line advertising companies. These embody pay-for-performance advertising, show advertising companies, the Taobaoke program, and placement companies. Sellers pay advertising charges to accumulate consumer site visitors and promote their services or products.

All Gold Provider members should meet strict standards with a view to preserve their elite standing. Third-party credit score reporting corporations additionally conduct an intensive authentication and verification course of.

Commissions on Transactions

Along with on-line advertising companies, sellers on Tmall and Juhuasuan additionally pay a fee based mostly on the gross merchandise quantity (GMV) of transactions settled by Alipay. Alibaba additionally earns income from commissions on transactions over AliExpress.

Membership and Worth-Added Providers

Alibaba generates substantial income from membership charges and value-added companies. These embody the sale of China TrustPass memberships on 1688.com and gold provider memberships on Alibaba.com, each of which permit wholesalers to host premium storefronts. Alibaba additionally presents value-added companies corresponding to product showcases and different enterprise options.

Key Takeaways from the Alibaba Income Mannequin

Listed here are among the key takeaways from the Alibaba Income Mannequin and the monetization strategies they use:

Numerous Income Streams: Alibaba income mannequin is extremely diversified, with revenue derived from varied sources corresponding to e-commerce, cloud computing, digital media, and leisure. This diversification mitigates dangers related to dependence on a single income supply.

Ecommerce Dominance: Majority of Alibaba’s income comes from its e-commerce companies, together with platforms like Taobao and Tmall. These platforms generate income by promoting and transaction charges from sellers who use these platforms to achieve customers.

Progress of Cloud Computing: Alibaba’s cloud computing section, Alibaba Cloud, has emerged as a big income supply. It supplies varied companies like knowledge storage, analytics companies, machine studying, and lots of extra to numerous companies, thereby producing revenue.

Digital Media and Leisure: Alibaba income mannequin additionally contains digital media and leisure companies like video streaming platform Youku Tudou and music streaming service Xiami, producing income by subscription and promoting.

Buyer-Centric Strategy: Alibaba’s major deal with buyer expertise and satisfaction has performed an instrumental position in its income development. By providing a variety of merchandise at aggressive costs by their custom-made smartphone apps, it has efficiently attracted and retained a big buyer base.

Cross-Border E-commerce: Alibaba has expanded globally, particularly specializing in cross-border e-commerce. It permits worldwide manufacturers to promote their merchandise to China’s huge shopper market, thus incomes transaction charges and boosting its income.

Knowledge-Pushed Technique: Alibaba makes use of knowledge analytics to grasp shopper habits higher, enabling it to offer personalised buyer experiences and enhance its companies. This data-driven technique has helped Alibaba enhance consumer engagement and, consequently, its income.

Conclusion

Alibaba income mannequin and monetization methods are a testomony to its modern and forward-thinking method to enterprise. The corporate’s numerous income streams, starting from on-line advertising companies to cloud computing, mirror its skill to adapt to altering market dynamics and shopper preferences. Crucially, Alibaba has harnessed the ability of information to deepen its understanding of its huge buyer base, enabling it to ship options that meet its evolving wants.

Alibaba’s continued dedication to innovation and diversification, balanced with an intensive comprehension of its prospects, underscores its potential for sustained development. Alibaba’s story reaffirms the significance of constantly evolving and adapting in at this time’s fast-paced digital economic system, and exemplifies the ability of a well-designed and well-executed income mannequin.