The road between the purchase aspect and promote aspect of digital promoting is getting blurrier by the day. Now PubMatic is crossing the aisle.

On Monday, the SSP introduced the launch of Activate, an end-to-end resolution lower from the identical fabric as Magnite’s ClearLine and The Commerce Desk’s OpenPath. Index Trade is sitting this one out.

Activate permits manufacturers and businesses to purchase CTV and on-line video stock by way of PubMatic by way of direct offers, together with programmatic assured and personal marketplaces. It doesn’t assist real-time bidding.

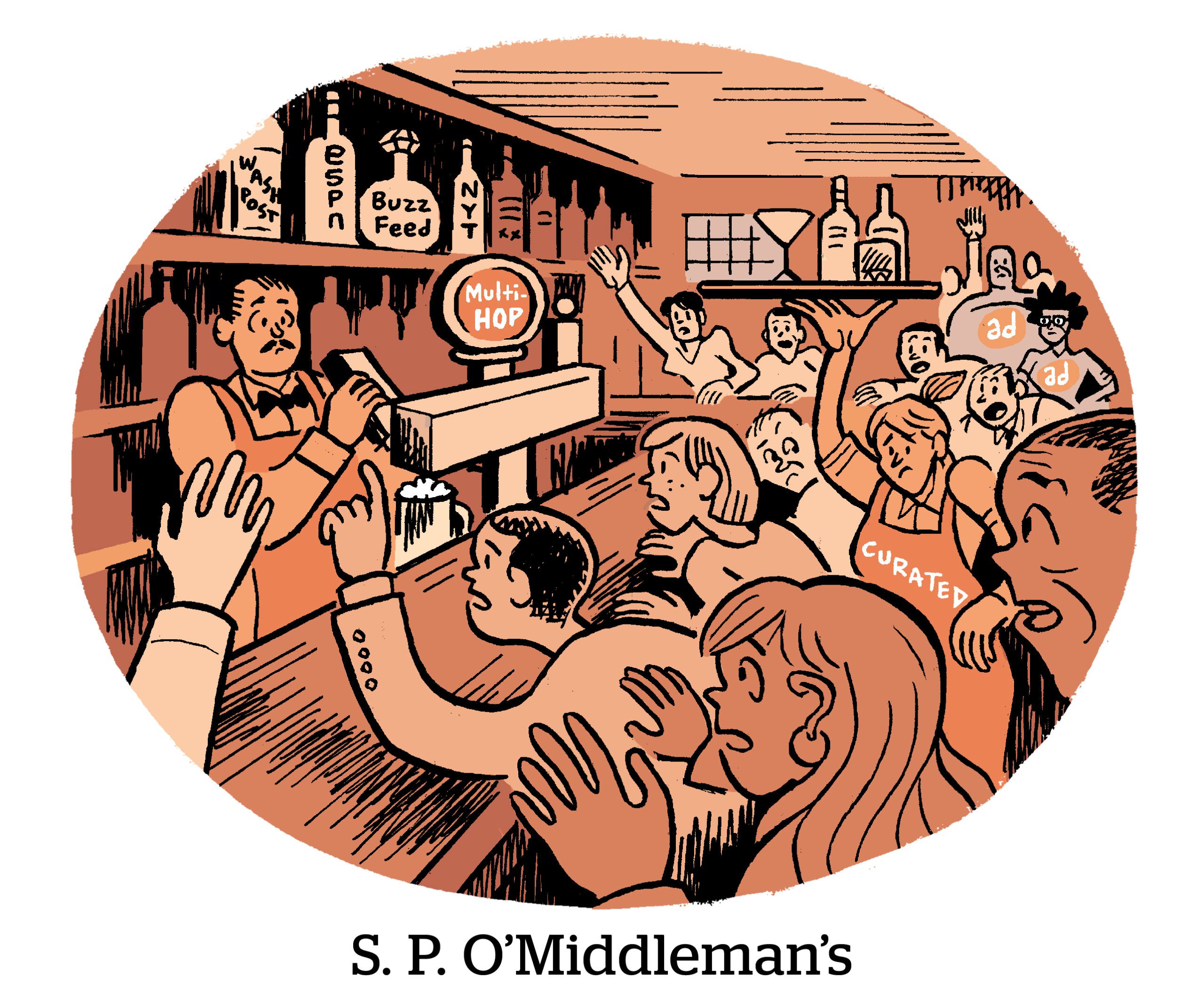

PubMatic is positioning Activate as an answer for provide path optimization (SPO), which is the observe of reducing out intermediaries from the availability chain.

“When you’ve gotten an SSP and a DSP, there are hops that result in discrepancies, latency, match fee points, information proliferation and elevated carbon consumption,” PubMatic CEO Rajeev Goel advised AdExchanger. “We challenged ourselves to say, ‘How can we seamlessly join the customer and vendor in a method that solves all of those challenges?’”

By bypassing DSPs, in fact.

The way it works

Activate lets patrons view out there stock, apply their first-party information to these out there audiences, activate campaigns and entry reporting and analytics for optimization. The product permits patrons to make use of whichever advert server they need.

PubMatic collects a share of the advertiser’s spend, though the corporate is contemplating subscription fashions as nicely, Goel mentioned.

PubMatic had been engaged on Activate for the previous 18 months. Its acquisition of measurement and reporting platform Martin in September accelerated the event course of by bringing in additional experience on the challenges businesses and advertisers face in marketing campaign planning, Goel mentioned. The Martin deal additionally introduced buy-side workflow instruments, analytics and optimization tech.

Activate’s launch companions embrace advert businesses Dentsu, Havas and OMG Germany, CPG model Mars, LG and FuboTV.

DSP disintermediation and SSP consolidation

PubMatic’s transfer is the most recent growth in what’s turn out to be a development, pushed by SPO, of the purchase aspect encroaching on promote aspect’s turf and vice versa.

SPO is basically a buy-side phenomenon, and efforts have principally been centered on reducing out SSPs, that are seen by some advertisers as commoditized companies with few distinctive advantages and subsequently expendable within the provide chain.

The Commerce Desk’s OpenPath and GroupM’s Premium Market are each good examples of buy-side gamers creating direct connections to writer stock.

However SSPs, together with Magnite and PubMatic, at the moment are trying to flip the script by going on to patrons and reducing out DSPs in an effort to stay aggressive.

“Knowledge is drying up on the purchase aspect of the ecosystem,” mentioned Goel, pointing to privateness laws and cookie and gadget ID deprecation.

When advertisers apply their focusing on and optimization information by way of sell-side platforms, they get greater match charges and higher ROI, Goel mentioned, as a result of SSPs have extra direct entry to publishers’ viewers information and may extra successfully curate writer stock.

The rise of sell-side marketing campaign activation and stock curation additionally means extra competitors between SSPs.

Consumers trying to curate stock on the promote aspect to make sure they’re shopping for the suitable advert placements want extra environment friendly instruments. “It doesn’t make sense, operationally, to do this throughout a dozen SSPs,” Goel mentioned. “You’re going to do this throughout one, two or three SSPs.”

Nonetheless, Activate represents a shift in focus for PubMatic, which has traditionally catered to the promote aspect solely. However the truth that the corporate is now additionally serving the wants of patrons doesn’t imply PubMatic is introducing a DSP, Goel mentioned.

“Our aim is to convey the non-programmatic, IO-based {dollars} which might be sitting on the sidelines into the programmatic ecosystem, which can profit DSPs and different ecosystem gamers,” he mentioned.

The hope is that by streamlining and automating direct buys for CTV and on-line video by way of a programmatic platform, advertisers might be inspired to spend extra.

However, Goel added, as media channels mature, advert spend tends to gravitate towards biddable stock, which DSPs are in the very best place to make the most of.

The battle for market share

Very like Magnite’s ClearLine, PubMatic’s Activate is targeted solely on video placements, together with each CTV and on-line video.

CTV stock continues to be primarily purchased by way of direct offers. PubMatic estimates that 57% of the $65 billion world CTV market is presently transacted by way of direct insertion orders. That’s $37 billion simply ready to go programmatic.

PubMatic additionally estimates that roughly 18% of the $150 billion on-line video market, or $28 billion, is transacted by way of direct IOs.

The choice by each PubMatic and Magnite to focus their end-to-end options on CTV may converse to a weak point DSPs have within the CTV market.

The Commerce Desk’s OpenPath connects advertisers to publishers by way of a customized Prebid adapter, that means the answer is especially suited to shopping for stock offered by way of open public sale. Since most CTV stock continues to be offered by way of direct IO, supply-side platforms need to nook this rising market by launching direct shopping for options particularly for CTV.

“We’re on this inflection of CTV progress,” Goel mentioned, “and there’s a transparent alternative to assist businesses and advertisers migrate these IOs into extra programmatic transactions.”

Correction 5/8/23: An earlier model of this text mentioned Magnite’s ClearLine was constructed on high of the SpringServe advert server, that means advertisers can solely entry stock from publishers that additionally use SpringServe. Magnite clarified that, though SpringServe is the inspiration for ClearLine, ClearLine is definitely server agnostic.

The article additionally initially mentioned ClearLine is just for CTV advert placements. Magnite clarified that ClearLine is for CTV and on-line video.