We proceed to place our idle cash to work in our portfolio. In the meanwhile, we’ll be specializing in additions reasonably than deletions (though that might change based mostly on new information). As soon as the debt ceiling stuff is resolved, I believe the market might be in a pleasant place to rally for the second half of the 12 months. Hopefully, we’ll have that purely political headache out of the way in which by subsequent week. Let’s check out what is going on on this week….

(Please get pleasure from this up to date model of my weekly commentary initially printed Could 25th within the POWR Shares Underneath $10 publication).

Shares have pulled again a bit and volatility has gone up as we method the debt ceiling. That is no shock (each the habits of the market and the truth that the ceiling has but to be resolved).

That being mentioned, I nonetheless suppose there’s a lower than a 1% likelihood we truly default on debt. A method or one other, one thing will get labored out.

Within the meantime, life goes on. Tech shares jumped 2.5% on Thursday after nice earnings from NVIDIA (NVDA).

Talking of NVDA, as overvalued as it might be (buying and selling at 218x earnings), the corporate has posted some very constructive information.

The inventory is now valued at virtually a trillion {dollars} and it’s the fifth largest element of the S&P 500 (SPY).

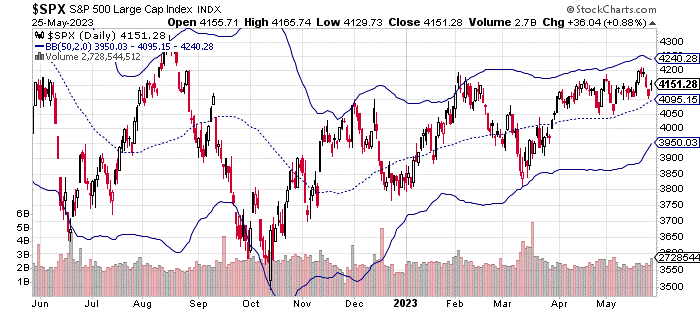

The S&P 500 pulled again to its 50-day transferring common earlier than the NVDA information despatched it again larger. It stays inside the 2 commonplace deviation vary which you can see on the chart above. Constructive information on a debt ceiling deal might ship the index a lot larger in a rush.

After all, as we get nearer to the precise debt restrict, volatility will go up and shares will go down. Most individuals don’t consider an precise default will occur, however the monetary markets haven’t any alternative however to react as we come right down to the wire.

There isn’t a complete lot of significant economics information this week, though PCE comes out after this concern is launched. The metric (which is a substitute for CPI by way of taking a look at inflation) might doubtlessly transfer the market if the outcomes are an enormous shock.

The markets at the moment are at a couple of 50/50 likelihood on a fee improve on the subsequent Fed assembly in June.

We’ve a number of extra weeks till then, so issues can clearly change. PCE outcomes could go a way in direction of convincing the markets somehow what the Fed goes to resolve.

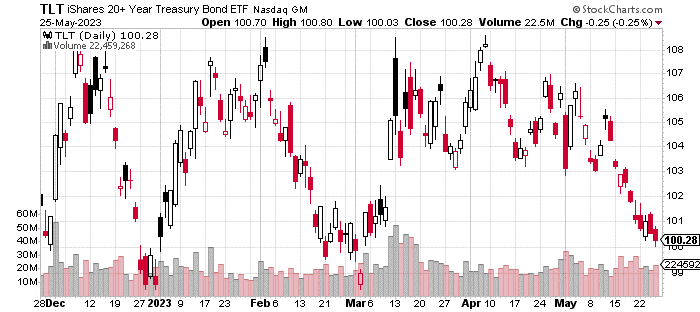

Trying on the chart of iShares 20+ 12 months Treasury Bond ETF (TLT), bond costs have come again down just lately.

Bear in mind, bond costs transfer inverse to bond yields, so this transfer is probably going because of the larger expectations of a fee hike than what we noticed a number of weeks in the past. If there’s a fee hike, I strongly suspect will probably be the final one of many 12 months.

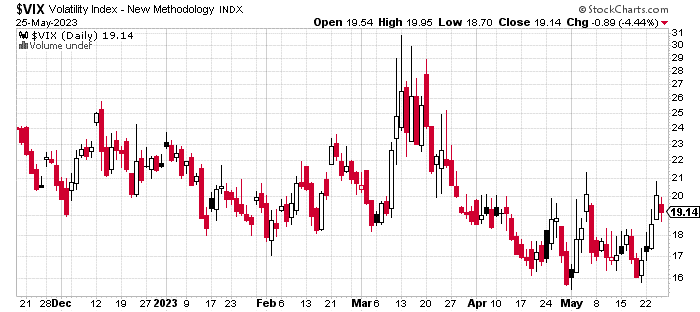

The VIX (the market volatility index) has climbed a good quantity during the last week as a response to the approaching debt ceiling. Once more, this isn’t actually a shock below the circumstances. The index remains to be below 20, which is concerning the long-term median stage. .

The 18-20 stage within the VIX doesn’t are typically a spot the index sits at for very lengthy (as you possibly can see within the chart above). It’s form of a transition stage traditionally.

Whether or not market volatility goes larger or decrease relies upon virtually solely on what occurs with the debt negotiations. We’ll know much more subsequent week.

What To Do Subsequent?

When you’d prefer to see extra high shares below $10, then it’s best to try our free particular report:

3 Shares to DOUBLE This 12 months

What offers these shares the precise stuff to change into huge winners, even on this challeging inventory market?

First, as a result of they’re all low priced corporations with essentially the most upside potential in right this moment’s unstable markets.

However much more vital, is that they’re all high Purchase rated shares in response to our coveted POWR Rankings system and so they excel in key areas of progress, sentiment and momentum.

Click on under now to see these 3 thrilling shares which might double or extra within the 12 months forward.

3 Shares to DOUBLE This 12 months

All of the Finest!

Jay Soloff

Chief Development Strategist, StockNews

Editor, POWR Shares Underneath $10 E-newsletter

SPY shares have been unchanged in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 10.25%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Jay Soloff

Jay is the lead Choices Portfolio Supervisor at Traders Alley. He’s the editor of Choices Flooring Dealer PRO, an funding advisory bringing you skilled choices buying and selling methods. Jay was previously knowledgeable choices market maker on the ground of the CBOE and has been buying and selling choices for over 20 years.

The put up Will Resolving the Debt Ceiling Contact Off the Subsequent Market Rally? appeared first on StockNews.com