For a lot of People, the significance of planning for retirement has in recent times change into an important monetary precedence as many soon-to-be retirees are gearing as much as exit the workforce within the coming years.

As folks become old, retirement planning takes a superior place amongst different monetary priorities. In a time the place the price of dwelling is continually rising, in opposition to the backdrop of an unsure future, planning on your monetary future turns into more and more difficult as you begin to age.

The state of retirement in America

Lately, a number of research and surveys have discovered that it is change into more and more laborious for People to avoid wasting and increase their retirement financial savings as a consequence of ongoing financial dangers

In a GOBankingRates survey of 1,000 People aged 18 years and older, round 32.9% had not more than $100 of their financial savings account. The same research revealed in 2022 discovered that almost 22% of People had lower than $100 of their financial savings accounts.

There is not any right time or age to start out planning or saving for the longer term, particularly when all the pieces appears to have so many added dangers today.

In accordance with a Northwestern Mutual 2021 Planning & Progress Research, People have in recent times been rising their retirement financial savings, with the typical retirement financial savings account rising by 13% from $87,500 to $98,800.

Regardless of many bumping up their saving efforts, soon-to-be retirees, these aged 55 to 64 have a median financial savings stability of $120,000, whereas youthful U.S. adults, below 35 at present have a median account stability of $12,300 in response to a PwC report.

Quite a few unplanned situations all through the previous couple of years have pressured many individuals into early retirement. Those that have been unable to correctly save and plan, have in recent times stepped out of retirement and again into the workforce as a strategy to financially maintain themselves.

The common age of retirement has elevated from 60 in 1990 to 66 in 2021 and with the vast majority of adults now dwelling longer than beforehand, having fun with life after work will be expensive if you happen to do not begin planning effectively earlier than the age of retirement arrives.

Retirement calculation – reducing prices earlier than retirement

Financial uncertainty and rising prices have beckoned American adults to start out saving early on of their careers.

From this, analysis reveals that for youthful earners, these born between 1981 and 1985, the retirement outlook is extra optimistic, as specialists predict them to have the very best inflation-adjusted median annual revenue by the point they attain 70.

Early millennials, as they’re known as, will see a 22% improve of their annual earnings as soon as they enter retirement, in comparison with pre-boomers, or these employees born between 1941 and 1945.

Era Z, people aged 19 to 25 are even higher at saving for his or her future, with a majority of them placing away on common 14% of their revenue in response to one BlackRock research revealed final 12 months.

Youthful generations have extra confidence, and extra optimism in the case of planning for his or her retirement and future. Now with a majority of them taking over area within the workforce, monetary priorities will quickly start to vary, as many look to construct a nest egg that might final them by retirement.

Following a strict price range, reducing pointless bills, and studying the way to work with cash are among the few issues many individuals are doing to cut back prices to stuff their retirement financial savings.

Cut back high-interest debt

Inflationary stress all through a lot of final 12 months has seen an more and more excessive variety of American adults lean on bank cards and private loans to assist them pay for on a regular basis bills. As of 2023, near half – 46% – of U.S. adults carry month-to-month debt, whether or not it is bank cards or different interest-related debt.

Holding bills to a minimal can begin by decreasing high-interest debt equivalent to bank cards or private loans. For almost all of the working class, whereas it is nonetheless attainable to afford it, it is advised to reduce any curiosity debt you should still have, whilst you’re nonetheless receiving a month-to-month revenue.

Having this monetary security internet means you are able to decrease your future bills and direct extra cash in direction of extra vital monetary objectives equivalent to saving for retirement.

Taking management of your debt is usually a problem, as these bills are inclined to accumulate over time, so it is best suggested to take a look at which funds will be handled firstly, and whether or not it is attainable to shorten the fee interval in order that it would not stretch into your retirement years.

Assess your insurance coverage protection

One other strategy to reduce bills early on in your profession is to evaluate your insurance coverage protection. As you change into older, medical health insurance protection turns into an more and more vital product that you’ll want to hold for a lot of your golden years.

Taking the required steps now to make sure you have the correct insurance coverage protection will make it easier to higher perceive what kind of product it is best to take out, and what you might be paying for.

Usually folks solely take out insurance coverage protection later of their life, as soon as they’re in a snug monetary place. Whereas this is able to make sense on the time, insurance coverage merchandise are inclined to change into dearer as you age.

Whereas the distinction in merchandise could also be a couple of {dollars} every month, over the long run these shortly add up. Chatting with a monetary skilled or dealer will provide you with higher steering on which insurance coverage merchandise are finest for somebody in your place, and will provide you with essentially the most advantages when you step into retirement.

Take management of scholar loans

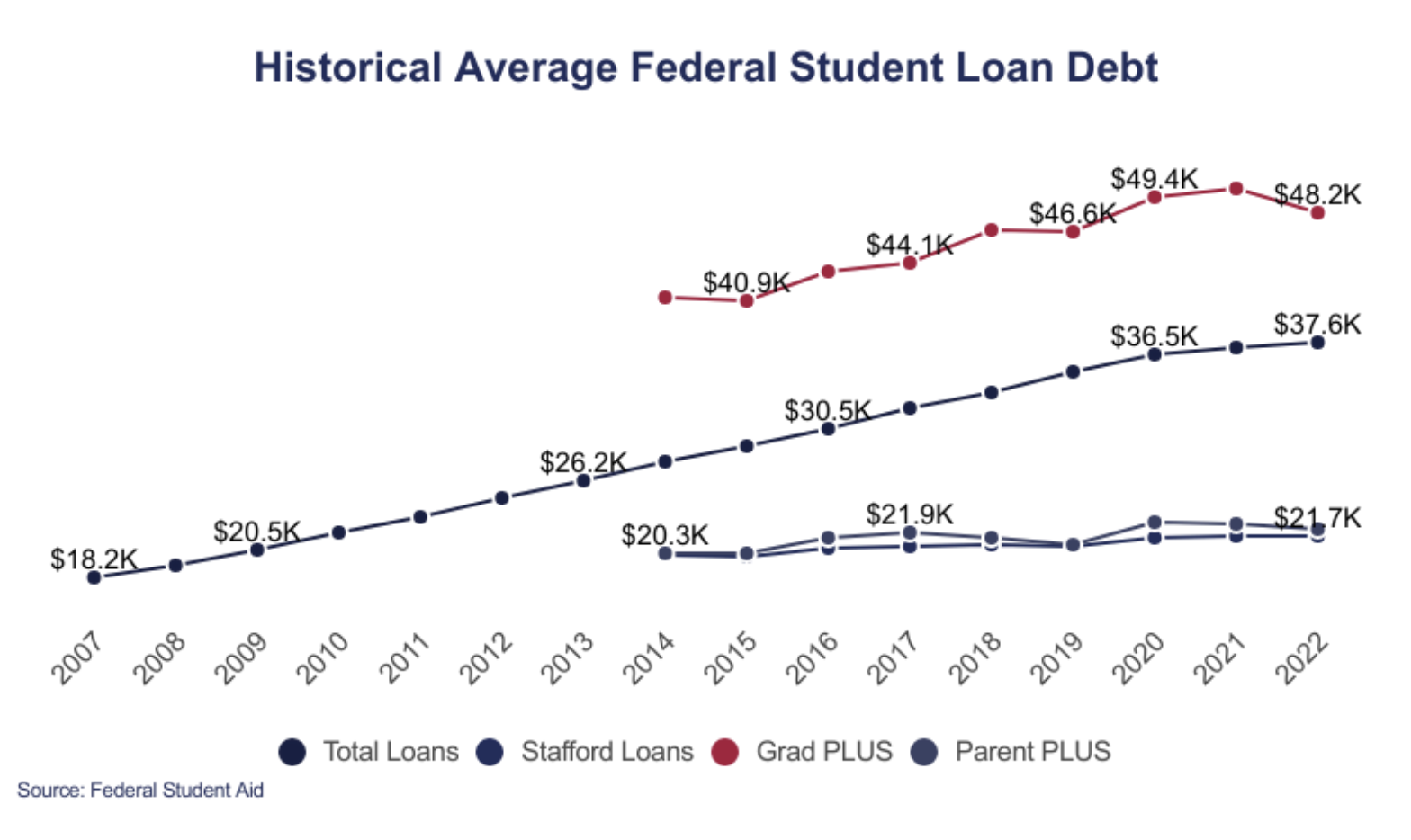

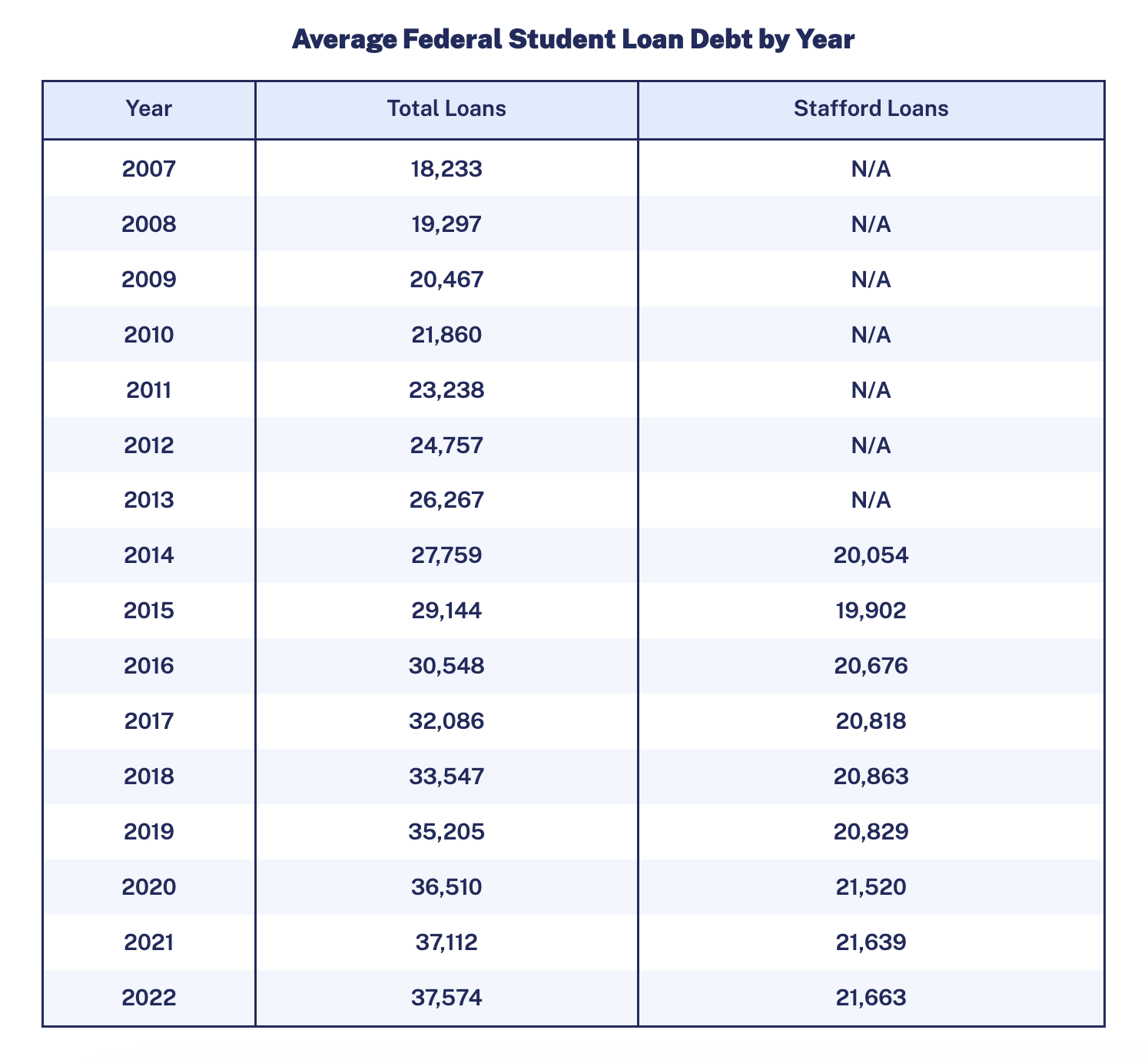

Pupil mortgage debt is an enormous burden for almost all of American adults. In accordance with the Schooling Knowledge Initiative, the typical federal scholar mortgage debt is $36,575 per borrower, whereas personal scholar mortgage debt averages $54,921 per borrower.

As of the beginning of this 12 months, round 45.3 million adults in America have some type of scholar mortgage debt, with a majority of them – 92% – having federal scholar mortgage debt.

Carrying this debt into retirement isn’t solely a monetary burden, nevertheless it takes a pressure in your retirement financial savings plans if you happen to do not handle to prioritize these funds.

Taking extra possession of your scholar mortgage debt now will make it easier to in the long run, permitting you to direct extra of your monetary efforts later in your life towards establishing your nest egg. In case you’re unsure the way to handle your scholar loans or have been struggling to make funds, attain out to a monetary advisor for steering, or apply for scholar mortgage reduction help.

In case you at present work within the public sector, or for a authorities entity, see whether or not there are any scholar mortgage reduction applications you possibly can qualify for to assist lighten the burden.

Pay-off your mortgage

Mortgage charges have almost doubled in a 12 months, because the Federal Reserve continues with its aggressive financial tightening, making it dearer for customers to borrow cash.

In mid-January 2023, the benchmark 30-year mortgage price was 6.48%, up from 3.22% on the similar time a 12 months in the past. In accordance with the U.S. Census Bureau, the median month-to-month mortgage fee sits round $1,100.

People have witnessed home costs soar in latest months, as demand grows, provide decreases, and the price of labor and constructing supplies proceed to rise.

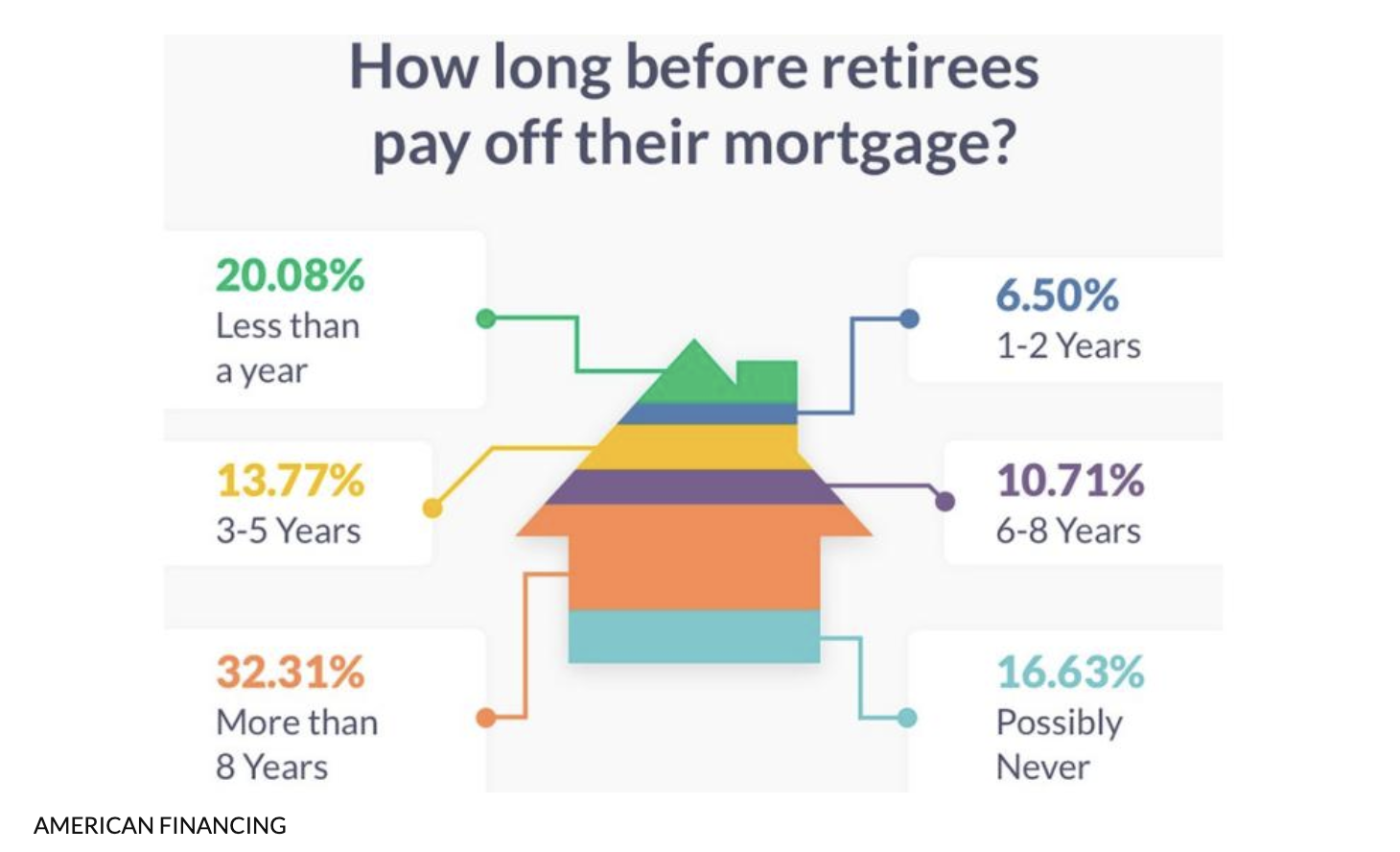

Regardless of these challenges, many adults nonetheless sit with a mortgage by the point they retire. Shockingly sufficient, 44% of People aged 60 to 70 have a mortgage as soon as they step into retirement, with 17% saying they may by no means be capable to fully pay it off in response to the American Affiliation for Retired Individuals.

Many soon-to-be retirees and even these nonetheless energetic within the workforce live with the excessive cost-burden of their mortgage. Being proactive to cut back these settlements whilst you’re nonetheless pulling a paycheck every month could make it easier to decrease your down fee time period, but in addition provide you with some respiration room to moderately put this cash in direction of your retirement fund.

A number of completely different monetary applications exist to assist owners with fulfilling their mortgage fee duties, and infrequently banks present clear and extra concise monetary steering. Take the chance to resolve these funds sooner moderately than later, and reap the benefits of decrease charges the place attainable.

Reassess your automotive insurance coverage

Car insurance coverage tends to extend over time, and insurance coverage suppliers regulate funds based mostly on inflation and the market worth of your automobile.

Over time, it’s possible you’ll find yourself paying barely extra on your automotive insurance coverage, even if you happen to nonetheless have the identical automotive, or maybe have downsized. Values for automotive insurance coverage are calculated by your insurance coverage supplier utilizing the precise money worth (ACV) of your automotive, to find out how a lot they might want to pay out within the occasion of an accident or to conduct any repairs on the automobile.

What some insurers have executed in more moderen occasions, is to offer decrease premiums for older prospects, to assist lighten the expense burdens they could have on their vehicles. This may make it rather a lot cheaper and maybe extra reasonably priced for some retirees or automotive house owners to carry onto multiple automotive.

Moreover, you possibly can method your present insurance coverage supplier to assist settle a extra manageable insurance coverage premium based mostly on a number of components equivalent to years of driving expertise, age, and situation of the automotive, the place it is parked in a single day, how typically you make use of it, and who the first driver of the automotive is likely to be.

These components, together with others will affect the overall month-to-month quantity you have to to pay on your insurance coverage. It is suggested to yearly assess your automobile insurance coverage to ensure you get essentially the most budget-friendly deal out there.

Minimize pointless bills and subscriptions

One other helpful and sensible strategy to reduce your bills early on in your profession is to keep away from any pointless bills equivalent to subscriptions, streaming providers, and web payments.

Whereas some could argue that these are important to their on a regular basis way of life and leisure. The most recent figures point out that the typical American spends roughly $114 on video downloads and streaming providers, an almost four-figure improve from 2016.

Web payments have additionally elevated during the last couple of years, regardless of seeing a rising variety of customers coming on-line.

The typical American family pays between $40 and $100 monthly for web providers, with the typical being $64 monthly. Even the bottom web packages can value households near $58 monthly when adjusted for taxes and different service charges.

Whereas there’s a want and use for these services or products within the on a regular basis family, it is typically finest to maintain these prices to a minimal. Splitting prices between these residing in the identical home or house will be a technique of bringing down bills.

One other may very well be to take out fewer streaming or subscriptions and hold solely the required merchandise which have a goal.

Make sure that to analysis the absolute best offers for a majority of these providers, and every now and then take a while to evaluate your account statements so to see the place your revenue is being spent.

You’ll be able to all the time decide out or cancel these subscriptions, however be sure that to learn the positive print first, in order that you do not find yourself paying a better cancellation charge, or proceed paying for one thing you not use.

The underside line

Planning for retirement has change into an important monetary precedence for a lot of People. For people who nonetheless have sufficient time earlier than the age of retirement, it is best to plan and strategize as a lot as attainable to make sure you’re on observe together with your monetary and financial savings objectives.

However, for these people which may quickly step out of the workforce, and into retirement, making some cutbacks to reduce pointless bills, whereas additionally boosting your retirement portfolio is maybe one of the best ways to make sure you can take pleasure in your golden years, with none monetary stress.

There is not any proper time to start out saving for retirement, the earlier you’ve gotten a financial savings plan in motion, the higher. Take management of your funds, and make an effort of breaking down the smaller prices, and reduce prices that might moderately be directed to your retirement fund.

The submit Small Adjustments, Huge Outcomes: What You Can Do To Decrease Prices And Plan For Retirement appeared first on Due.